Calculating total compensation in dollars per hour for each of these job classes

Employers and pay equity committees are required to calculate the compensation, in dollars per hour, for each predominantly male and female job class for which the value of work has been determined.

Definition of compensation

Compensation is defined as any form of payment received for work performed by an employee and includes:

- salaries;

- commissions;

- vacation pay;

- severance pay;

- bonuses;

- payments in kind;

- employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and,

- any other advantage received directly or indirectly from the employer.

To calculate the compensation for each job class in the pay equity plan, employers or pay equity committees may use the Total Compensation Model.

The total compensation model

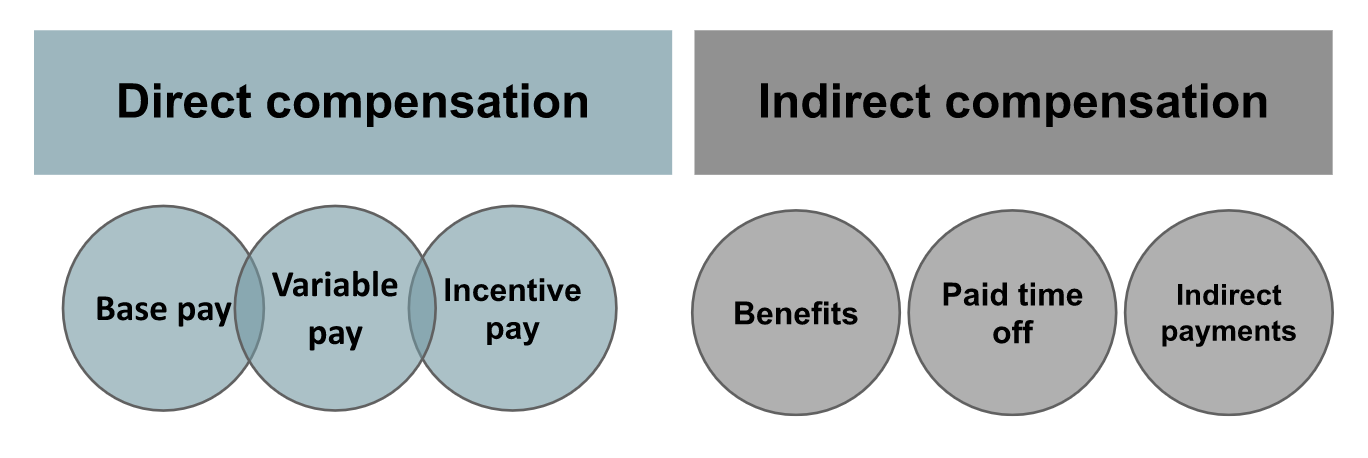

The Total Compensation Model includes three elements of direct compensation and three elements of indirect compensation:

The table below includes a summary of the types of compensation elements that may need to be included in the calculation of total compensation as well as guidance on how these elements should be calculated for the purpose of pay equity.

| Examples compensation elements | Summary of guidance for pay equity purposes | ||

|---|---|---|---|

| Direct compensation | Base pay |

|

Base pay refers to a regular compensation amount or wage employers agree to pay before taxes and other deductions. Base pay does not include benefits or additional earning opportunities such as incentive plans. |

| Variable pay |

|

If variable pay amounts are fixed or predictable, the average or median target rate for the job class may be used as base pay. If variable pay amounts are not predictable and are added to base pay, these amounts may be calculated as incentive pay. If the compensation structure only includes variable pay amounts that are not fixed or predictable, the value “0” can be used as base pay. |

|

| Incentive pay |

|

Amounts received for “above” target levels performance, through a formal merit-based (or incentive) compensation plan that has been formally brought to the attention of employees are considered incentive pay. The way incentive pay amounts should be taken into account in the calculation of compensation depends on a number of criteria. |

|

| Indirect compensation | Benefits |

|

If the benefit is equally available and provided without discrimination on the basis of gender to all the male and female predominant job classes covered by the pay equity plan, it may be excluded from the calculation of compensation as provided in the Act. |

| Paid time off |

|

If paid time off is equally available and provided without discrimination on the basis of gender to all the male and female predominant job classes covered by the pay equity plan, it may be excluded from the calculation of compensation. |

|

| Indirect payments |

|

Indirect payments can include elements such as paid equipment and tools that are not a condition of employment or business requirement. |

|

Key principles

Dollars per hour

Employers and pay equity committees must calculate the compensation of each job class in dollars per hour. This means, for example, that if the base pay of a job class is an annual amount, this amount must be converted to an hourly amount.

Highest salary rate

Employers or pay equity committees must use the highest salary rate in the range of salary rates when calculating total compensation. This means that when there is a defined salary range for a job class and all employees can expect to realize the maximum salary rate in the range at some point, that maximum is defined as the highest rate. If there is only one rate of pay for a given job class, that rate is the one to be used.

Exclusions

Certain elements can be excluded from the calculation of total compensation for each predominantly male and female job class. In other cases, elements must be excluded from the calculation of total compensation for each predominantly male and female job classes.

More information

An Excel tool to convert annual salary to an hourly amount is available in the Pay Equity Toolkit.

For more information on the total compensation model, the exclusions, the definition of salary and the highest rate, variable pay, incentive pay and indirect compensation, please consult our library of publications: https://www.payequitychrc.ca/en/publications.

- Date modified: