Calculation of Compensation – No. 1 Guidance concerning the definition of compensation

1. Purpose

This Interpretation, Policy and Guideline (IPG) provides guidance on:

- An approach for calculating compensation;

- The definition of compensation; and,

- Elements of a total compensation model.

This IPG is the first of a series that addresses the calculation of compensation. The other IPGs in this series are:

- No. 2: Exclusions.

- No. 3: An Interpretation of Salary and Determining the Highest Salary Rate.

- No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay.

- No. 5: Guidance Concerning the Calculation of Different Types of Incentive Pay.

- No. 6: Guidance Concerning the Calculation of Indirect Compensation Elements.

This document does not replace expert legal and/or compensation advice. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequitychrc.ca/en.

The term employer in this document can also refer to a group of employers that has been recognized by the Pay Equity Commissioneri.

2. An introduction to the calculation of compensation

Section 44(1) of the Pay Equity Act (the Act) requires the employer or pay equity committee to calculate the compensation, expressed in dollars per hour, associated with each job class for which it has determined the value of work performedii. There is no need to complete this step for any gender-neutral job classes.

The Act outlines that the employer or pay equity committee may excludeiii any form of compensation that is equally available and provided without discrimination on the basis of gender with respect to all predominantly male and predominantly female job classes for which total compensation is being determined.

The Act also outlines that certain forms of compensation must be excludediv from the calculation of compensation for a job class provided they are designed and applied so as not to discriminate on the basis of gender.

The final calculation of compensation must be expressed in dollars per hour.

For more information on exclusions, see Calculation of Compensation – No. 2: Exclusions on the pay equity publications web page: https://www.payequitychrc.ca/en/publications.

3. Definition of compensation

Section 3(1) of the Pay Equity Act defines compensation as any form of remuneration payable for work performed by an employee and includes:

- Salaries, commissions, vacation pay, severance pay and bonuses;

- Payments in kind;

- Employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and,

- Any other advantage received directly or indirectly from the employer.

4. Total compensation model

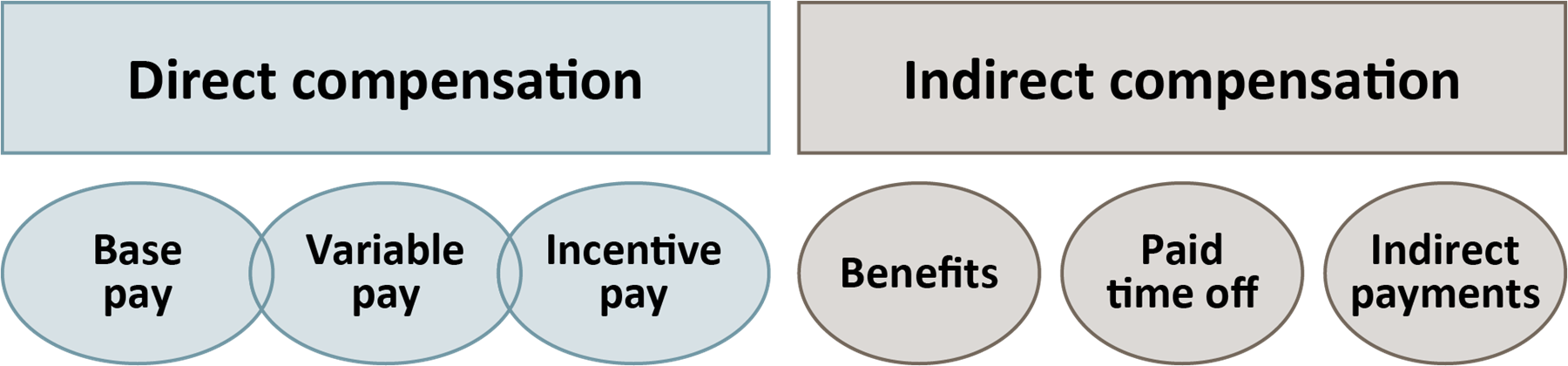

To advance pay equity and ensure that the calculation of compensation includes every advantage received directly or indirectly from the employer,v compensation should be interpreted as total compensation and include elements across the six types of compensation outlined in the total compensation model.

While there are varying types and definitions of direct and indirect compensation used by employers, the foundational descriptions below are provided for guidance.

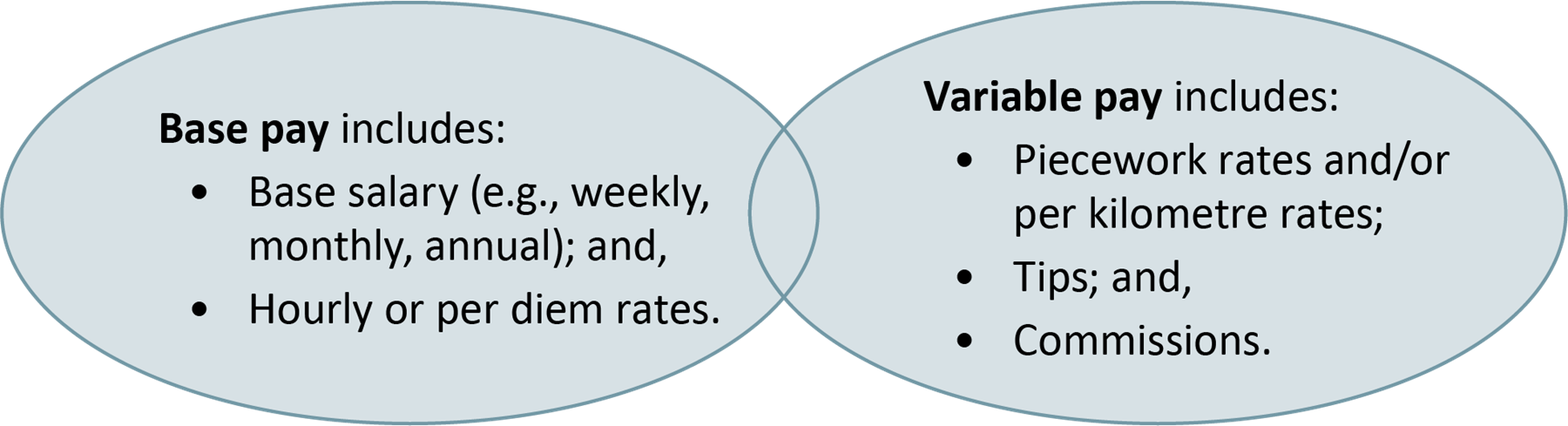

Direct compensation includes:

- Base pay, such as:

- Base salary (e.g., weekly, monthly, annual); and,

- Hourly or per diem rates.

- Variable pay, typically volume-based, such as:

- Piecework rates and/or per kilometre rates;

- Tips; and,

- Commissions.

- Incentive pay, typically tied to a known goal such as a specific performance indicator or metric, such as:

- Individual or team-based bonus or incentive plans (e.g., annual, mid-term);

- Long-term incentives (e.g., stock options, share units); and,

- Profit or gain sharing.

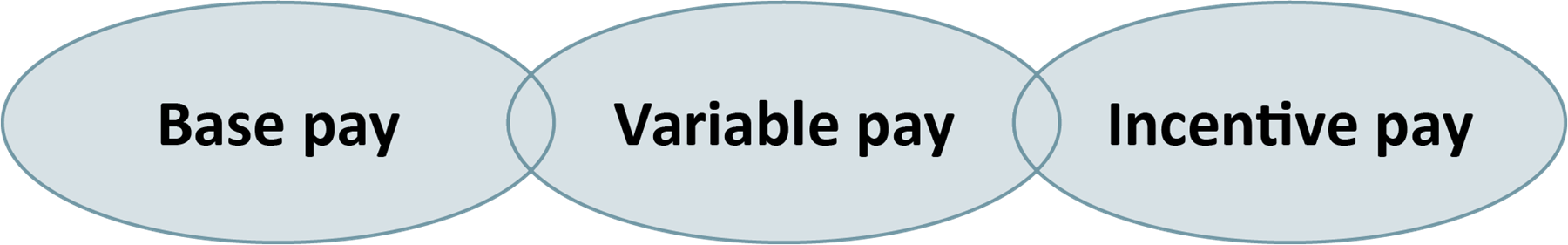

There are a multitude of compensation structures in federally regulated workplaces across Canada. Some employers use only one direct compensation element, such as base pay, in their compensation structures, while others may use all three direct compensation elements. It is important to note that in some cases, all three elements may be interrelated, while in others they are not. For example, in some organizations, variable pay may be used as a base pay substitute.

Indirect compensation includes:

- Benefits received by employees, such as:

- Health and dental plans;

- Health spending accounts;

- Counselling services;

- Income protection, short-term disability, long-term disability and life insurance;

- Pension or RRSP plans; and,

- Severance entitlements.

- Paid time off, such as:

- Vacation;

- Paid sick leave;

- Bereavement or compassionate care leave; and,

- Personal leave.

- Indirect payments, such as:

- Parking and car allowances, if not a business expense;

- Professional memberships, if not a condition of employment;

- Payments in kind; and,

- Interest-free loans.

Indirect compensation also includes any personal use indirect payments, such as:

- Personal cellular or computer allowances;

- Wellness and fitness benefits; and,

- Social or recreational memberships.

4.1. Base pay

In the total compensation model, the term base pay includes salary, hourly rates and, in some cases, fixed or predictable variable pay amounts:

Base pay is the established (or regular) compensation amount or wage employers agree to pay before taxes and other deductions. Base pay does not include benefits or additional earning opportunities such as incentive plans.

For more information on the different types of base pay, see Calculation of Compensation – No. 3: An Interpretation of Salary and Determining the Highest Salary Rate: https://www.payequitychrc.ca/en/publications.

4.2. Variable pay

Variable pay captures cash payments that an employee receives—for example, based on distance driven or production volumes. It includes elements such as piecework rates, per kilometre rates, tips and commissions.

Some organizations use compensation structures that include fixed or predictable variable pay elements. In these cases, the employer or pay equity committee may calculate the average or median target rate for the job class as base pay. These calculations should reflect how much an employee who is meeting target levels can realistically earn.

Some organizations use compensation structures that include variable pay amounts, in addition to base pay, that are not predictable, often linked to a measure of targeted or stretch levels of performance. In these cases, at-risk performance-based pay amounts may be calculated as incentive pay.

Finally, some organizations use compensation structures that include only variable pay amounts that are not fixed or predictable. In these cases, the employer or pay equity committee may choose to use “0” as base pay. To avoid fluctuations associated with this type of pay, it may be helpful to analyze earnings over a longer period of time.vi

For more information, see Calculation of Compensation – No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay: https://www.payequitychrc.ca/en/publications.

For more information, see Calculation of Compensation – No. 5: Guidance Concerning the Calculation of Different Types of Incentive Pay: https://www.payequitychrc.ca/en/publications.

4.3. Incentive pay

Employers may use a performance-based at-risk compensation plan, or bonuses, to incent and reward employees. These types of compensation plans are typically tied to risk-based individual, team and/or enterprise-wide performance objectives.

Amounts received for above-target levels of performance, through a formal merit-based (or incentive) compensation plan that has been formally brought to the attention of employees, are considered incentive pay. Incentive pay may be subtracted from the calculation of total compensation should it meet the exclusion criteria outlined in section 46 of the Pay Equity Act (the Act).

When incentive pay does not meet the exclusion criteria outlined in section 46 of the Act, it may be necessary to include the target rate or, in the absence of a target rate, the average or the median of target rate payments in the calculation of total compensation for the purposes of pay equity.

For more information, see Calculation of Compensation – No. 2: Exclusions: https://www.payequitychrc.ca/en/publications.

For more information, see Calculation of Compensation – No. 5: Guidance Concerning the Calculation of Different Types of Incentive Pay: https://www.payequitychrc.ca/en/publications.

4.4. Benefits received by employees

Benefits received by employees can range from health and dental plans, to counselling services, to pension or RRSP plans.

For pay equity purposes, if the benefit is equally available and provided without discrimination on the basis of gender to all the predominantly male and predominantly female job classes covered by the pay equity plan, it may be excluded from the calculation of compensation in accordance with section 45 of the Act.

If the benefit is not excluded, in most cases, the employer-paid portion or cost must be calculated and included in the calculation of compensation for the job class.

4.5. Paid time off

Like benefits, if paid time off is equally available and provided without discrimination on the basis of gender to all the predominantly male and predominantly female job classes covered by the pay equity plan, it may be excluded from the calculation of compensation in accordance with section 45 of the Act.

If different paid time off policies apply to job classes covered by the pay equity plan, then the amounts will need to be calculated for each job class.

The calculations related to the value of paid time off should account not for individual usage of paid time off but for what is accessible to the job class.

4.6. Indirect payments

Indirect payments include a range of elements of compensation, such as wellness benefits, car allowances and payments in kind. Indirect payments can include elements such as paid equipment and tools that are not a condition of employment or a business requirement.

For more information on benefits, paid time off and indirect payments, see Calculation of Compensation – No. 6: Guidance Concerning the Calculation of Indirect Compensation Elements: https://www.payequitychrc.ca/en/publications.

5. Referenced Pay Equity Act provisions

3(1)

compensation means any form of remuneration payable for work performed by an employee and includes

- salaries, commissions, vacation pay, severance pay and bonuses;

- payments in kind;

- employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and

- any other advantage received directly or indirectly from the employer. (rémunération)

Job classes

32 An employer — or, if a pay equity committee has been established, that committee — must start by identifying the job class of positions occupied or that may be occupied by employees to whom the pay equity plan relates. Subject to section 34, positions are considered to be in the same job class if

- they have similar duties and responsibilities;

- they require similar qualifications; and

- they are part of the same compensation plan and are within the same range of salary rates.

Criterion

42 The criterion to be applied in determining the value of the work performed is the composite of the skill required to perform the work, the effort required to perform the work, the responsibility required in the performance of the work and the conditions under which the work is performed.

Calculation

44 (1) An employer — or, if a pay equity committee has been established, that committee — must calculate the compensation, expressed in dollars per hour, associated with each job class for which it has determined, under section 41, the value of the work performed.

Group of job classes

(2) If an employer or pay equity committee, as the case may be, treats a group of job classes as a predominantly female job class in accordance with section 38, the compensation associated with that job class is considered to be the compensation associated with the individual predominantly female job class within the group that has the greatest number of employees.

Salary

(3) For the purpose of determining salary in the calculation of the compensation associated with a job class, the salary at the highest rate in the range of salary rates for positions in the job class is to be used.

Exclusions from compensation

45 An employer — or, if a pay equity committee has been established, that committee — may exclude from the calculation of compensation, with respect to each job class in respect of which compensation is required to be calculated, any form of compensation that is equally available, and provided without discrimination on the basis of gender, in respect of all of those job classes.

Differences in compensation excluded

46 An employer — or, if a pay equity committee has been established, that committee — must exclude from the calculation of compensation associated with a job class any differences in compensation that either increase or decrease compensation in any or all positions in that job class as compared with the compensation that would otherwise be associated with the position, if the differences are based on any one or more of the following factors and those factors have been designed and are applied so as not to discriminate on the basis of gender:

- the existence of a system of compensation that is based on seniority or length of service;

- the practice of temporarily maintaining an employee’s compensation following their reclassification or demotion to a position that has a lower rate of compensation until the rate of compensation for the position is equivalent to or greater than the rate of compensation payable to the employee immediately before the reclassification or demotion;

- a shortage of skilled workers that causes an employer to temporarily increase compensation due to its difficulty in recruiting or retaining employees with the requisite skills for positions in a job class;

- the geographic area in which an employee works;

- the fact that an employee is in an employee development or training program and receives compensation at a rate different than that of an employee doing the same work in a position outside the program;

- the non-receipt of compensation — in the form of benefits that have a monetary value — due to the temporary, casual or seasonal nature of a position;

- the existence of a merit-based compensation plan that is based on a system of formal performance ratings and that has been brought to the attention of the employees; or,

- the provision of compensation for extra-duty services, including compensation for overtime, shift work, being on call, being called back to work and working or travelling on a day that is not a working day.