Calculation of Compensation – No. 3 An interpretation of salary and determining the highest salary rate

1. Purpose

This Interpretation, Policy and Guideline (IPG) covers the following:

- An interpretation of the term salary;

- Calculating hourly rates; and,

- Determining the salary at the highest rate in a range of salary rates.

This IPG is the third of a series that address the calculation of compensation. The other IPGs in this series are:

- No. 1: Guidance Concerning the Definition of Compensation.

- No. 2: Exclusions.

- No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay.

- No. 5: Guidance Concerning the Calculation of Different Types of Incentive Pay.

- No. 6: Guidance Concerning the Calculation of Indirect Compensation Elements.

This document does not replace expert legal and/or compensation advice. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequitychrc.ca/en.

The term employer in this document can also refer to a group of employers that has been recognized by the Pay Equity Commissioner.i

2. Definition of salary

For the purposes of the Pay Equity Act (the Act), salary may be defined as a fixed or predictable amount of direct compensation received by an employee, typically over a prescribed annual cycle, that may be referred to as base pay.

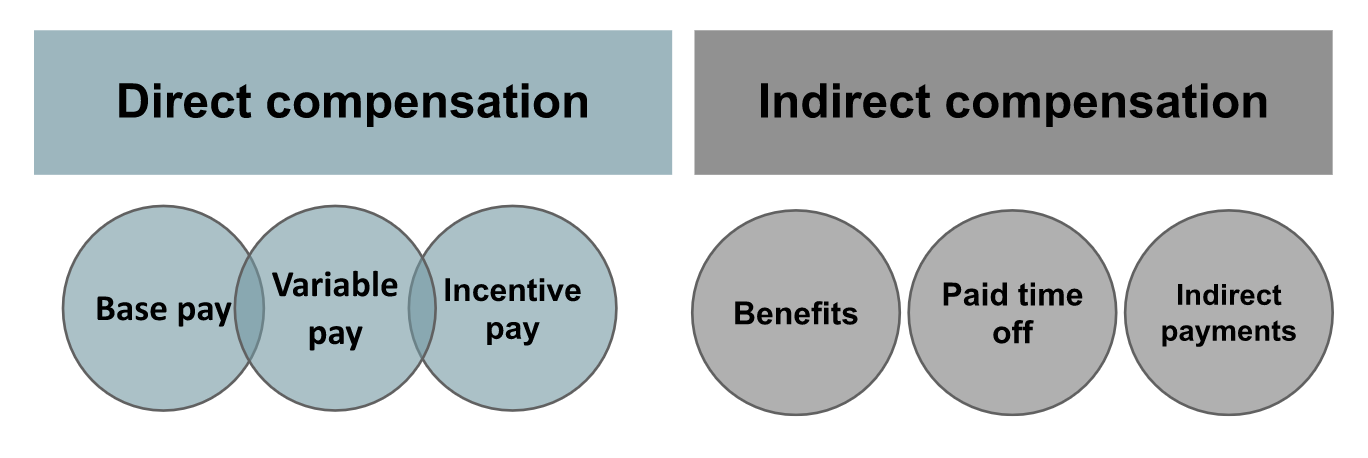

Direct compensation includes:

- Base pay;

- Variable pay; and,

- Incentive pay.

Indirect compensation includes:

- Benefits;

- Paid time off; and,

- Indirect payments.

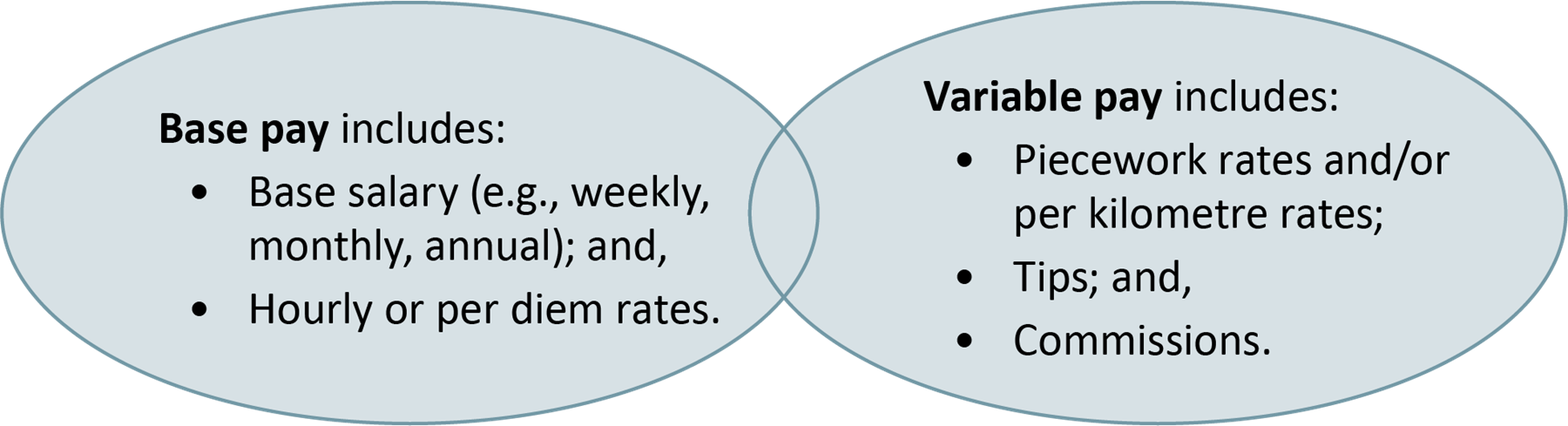

In the total compensation model, the term base pay includes base salary, hourly rates and, in some cases, fixed or predictable variable pay amounts.

Base pay includes:

- Annual base salary (typically paid weekly, biweekly or monthly); and,

- Hourly rates.

Variable pay includes:

- Piecework rates and per kilometre rates;

- Tips; and,

- Commissions.

The Act does not provide a definition of salary. Therefore, this interpretation of salary is non-binding but provides flexibility for the purpose of recognizing and responding to the numerous types of pay structures present in federally regulated workplaces across Canada.

3. Guidance on calculating hourly rates

Section 44(1) of the Pay Equity Act outlines that the calculation of compensation for each predominantly male and each predominantly female job class must be expressed in dollars per hour.

An employer or pay equity committee may already have hourly salary rates available for each job position.ii Should this not be the case, any annual base pay amounts and any fixed or predictable variable pay amounts may be converted to hourly rates using the following two formulas:

Total number of hours worked in a year = Weekly hours for the job class × 52 (number of workweeks in a year)

Hourly rate = Annual amounts (annual base pay and annual variable pay) ÷ Total number of hours worked in a year

Example: Calculating hourly rates from annual amounts

The pay equity committee has the annual amounts for each job position within job class A and now has to convert these to hourly rates.

Each job position within job class A works 37.5 hours per week and 52 weeks per year.

The pay equity committee conducts the following calculations to determine the hourly rate for job position 1:

Total number of hours worked in a year = Weekly hours for the job class × 52 (number of workweeks in a year)

= 37.5 × 52

= 1,950

Hourly rate = Annual amounts ÷ Total number of hours worked in a year

= $48,750 ÷ 1,950

= $25.00

Annual amounts and hourly rates for job class A:

| Job position | Annual amounts ($) | Hourly rate ($/hour) |

|---|---|---|

| 1 | 48,750 | 25.00 |

| 2 | 48,000 | 24.62 |

| 3 | 51,000 | 26.15 |

| 4 | 47,000 | 24.10 |

| 5 | 52,000 | 26.67 |

4. Guidance on determining the highest rate in a range of salary rates

It is important for the employer or pay equity committee to remember that a job class can be created only with job positions that have similar duties and responsibilities, that require similar qualifications and that are part of the same compensation plan and within the same range of salary rates.iii

4.1. Creating a range of salary rates

An employer or pay equity committee may already have a range of salary rates for their job classes. Should this not be the case, once the hourly rate for each job position within a job class has been calculated, the employer or pay equity committee can create a range of hourly salary rates for the purposes of pay equity.

The highest rate in the range of salary rates is to be used to calculate the compensation of a job class.

4.2. Determining the highest rate in a range of salary rates

There are three broad scenarios that reflect how job classes are paid salary and prescribe how to apply the definition of salary to determine the highest rate in the range of salary rates:

- Job classes that receive only base pay;

- Job classes that receive fixed or predictable variable pay; and,

- Job classes that receive no base pay or fixed or predictable variable pay.

The following sections provide information on these three broad scenarios, examples of the types of compensation structures they include and guidance on how to identify the highest rate in a range of salary rates.

4.2.1. Job classes that receive only base pay

For those job classes that receive only base pay, in most circumstances, the employer or pay equity committee would use the highest rate in the range of salary rates or the highest rate actually being paid in cases where there is no pre-established range of salary rates.

There are numerous base pay compensation structures that will be covered as examples.

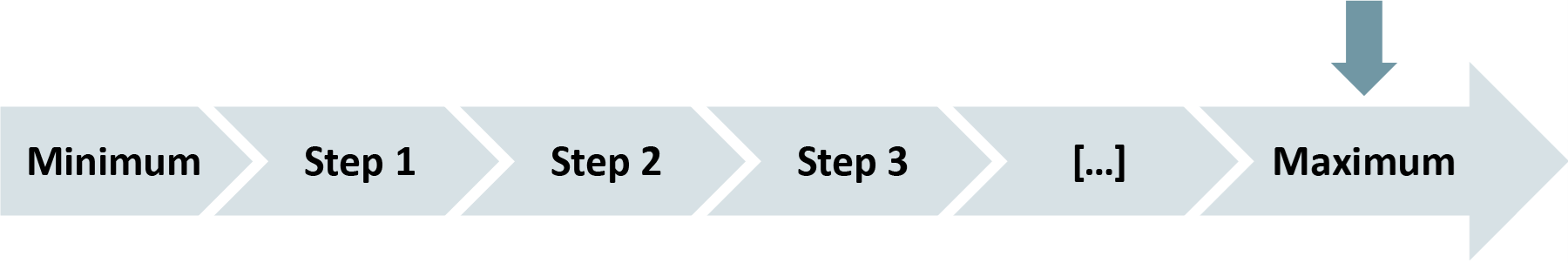

Base salary structure with formal steps

Employees are paid a rate within a range. An employee’s rate of pay moves from one step to the next based on, for example, experience gained in the position.

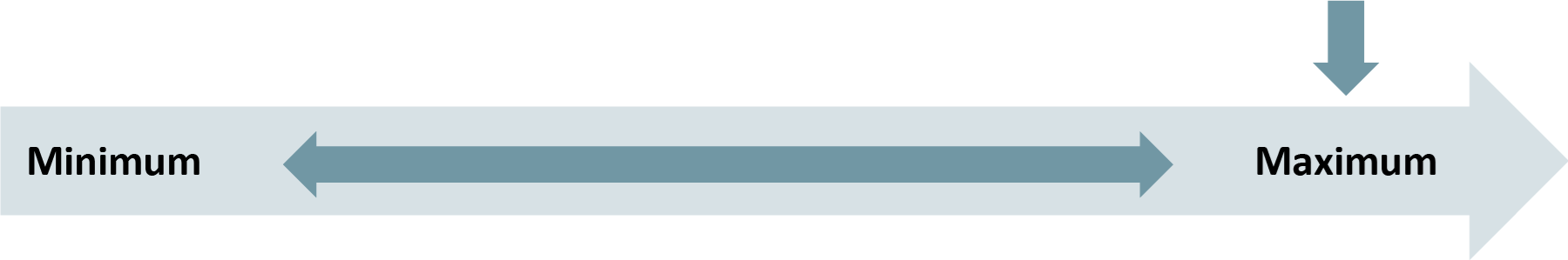

Base salary structure with a range

Employees are paid a regular rate within a range. An employee’s rate of pay can vary between the range minimum and maximum, depending on factors such as experience or satisfactory performance. All employees, however, can expect to achieve the maximum or highest base salary rate in the prescribed range within a defined period of time.

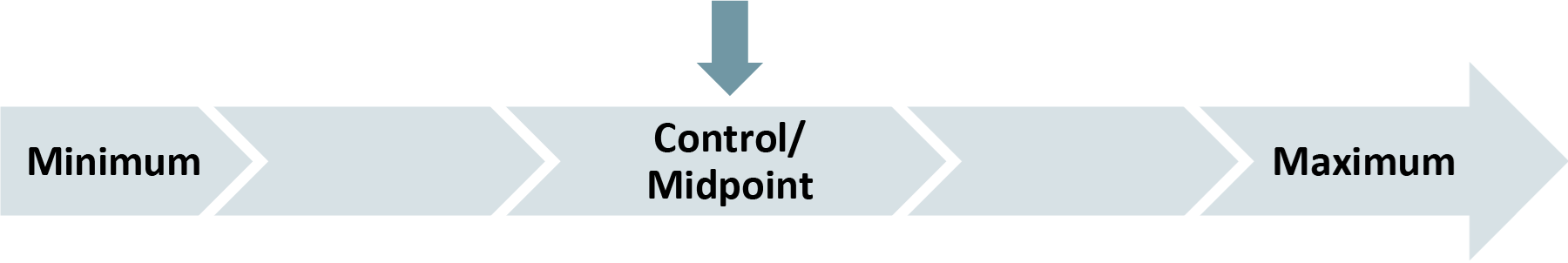

Broad-banded merit-based salary range

Employees are paid a regular rate within a published salary range, where all employees can expect to achieve a fully competent merit-based control point or midpoint over a reasonable period of time (for example, three to four years). Progression through the range is based on measured individual merit (performance).

Only sustained above-target performance would result in base pay placement above the defined control point or midpoint. Rates paid above the control point or midpoint up to the range maximum are tied to merit for above-average performance and/or formally measured advanced competencies that are determined through a formal performance management program.

In these situations, the employer or pay equity committee may use the control point or midpoint rate as the highest rate in the range of salary rates, as any amounts received for above-target performance beyond the control point or midpoint are merit based and may be subject to exclusion under section 46(g) of the Pay Equity Act (the Act).

See Calculation of Compensation – No. 2: Exclusions and Calculation of Compensation – No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay for more information: https://www.payequitychrc.ca/en/publications.

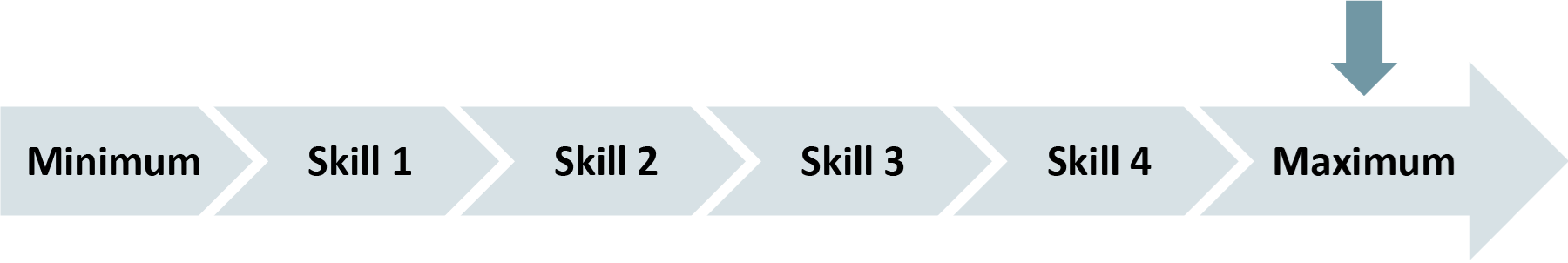

Skill-based pay structure

Employees are paid a regular rate within a published range. An employee’s rate of pay can vary between the range minimum and maximum, dependent upon acquiring or demonstrating a specific set of skills or competencies. All employees, however, are eligible to achieve the maximum or highest base salary rate in the prescribed range provided they acquire and demonstrate these specific skills or competencies. In this circumstance, the highest base salary rate is used for the purposes of the pay equity exercise.

Single rate

There is no salary range. All employees in the job class are paid the same base pay rate. This base pay rate is the rate to be used as the highest rate.

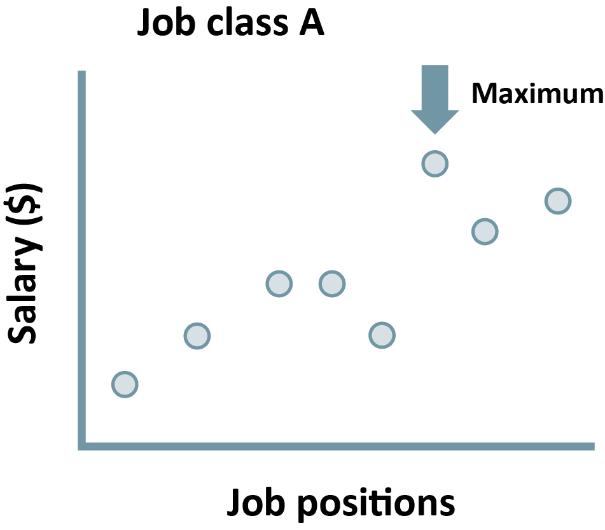

No formal base pay structure

There is no published salary range. Employees in the same job class may be paid different rates—for example, tied to individually negotiated salaries or based on prior earnings. In these situations, the employer or pay equity committee must use the highest rate paid to incumbents in the job class.

4.2.2. Job classes that receive fixed or predictable variable rate of pay

For job classes that receive fixed or predictable variable base pay, the employer or pay equity committee would create a range of base pay rates, based on the actual, at-target variable base pay rates received for the job class over a reasonable period of time.

Here is an example of this type of scenario:

An employee is paid at predetermined intervals tied to a variable component such as productivity (for example, piecework) or sales dollars or volume (for example, a draw against commission) where there is a fixed or predictable earning based on target performance. The rate is not tied to hours worked.

To calculate the highest salary rate, the employer or pay equity committee may use the average or median at-target amount that a competent employee would expect to receive over a representative period of time.iv

4.2.3. Job classes that receive variable pay amounts that are not fixed or predictable

For those job classes that receive no base pay but only variable pay amounts that are not fixed or predictable (for example, commissions) that are based on volume or performance outcomes, the employer or pay equity committee may choose to put “0” as the highest rate in the range of salary rates.

In this circumstance, the employer or pay equity committee could then use the median or average amount earned by all positions in the job class to calculate the variable pay component of total compensation. Amounts received for above-target volume or performance outcomes may be subject to exclusion as incentive pay, should they meet the criteria outlined in section 46 of the Act.

For more information, see Calculation of Compensation – No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay: https://www.payequitychrc.ca/en/publications.

5. Referenced Pay Equity Act provisions

3(1)

compensation means any form of remuneration payable for work performed by an employee and includes

- salaries, commissions, vacation pay, severance pay and bonuses;

- payments in kind;

- employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and

- any other advantage received directly or indirectly from the employer. (rémunération)

Job classes

32 An employer — or, if a pay equity committee has been established, that committee — must start by identifying the job class of positions occupied or that may be occupied by employees to whom the pay equity plan relates. Subject to section 34, positions are considered to be in the same job class if

- they have similar duties and responsibilities;

- they require similar qualifications; and

- they are part of the same compensation plan and are within the same range of salary rates.

Calculation

44 (1) An employer — or, if a pay equity committee has been established, that committee — must calculate the compensation, expressed in dollars per hour, associated with each job class for which it has determined, under section 41, the value of the work performed.

Group of job classes

(2) If an employer or pay equity committee, as the case may be, treats a group of job classes as a predominantly female job class in accordance with section 38, the compensation associated with that job class is considered to be the compensation associated with the individual predominantly female job class within the group that has the greatest number of employees.

Salary

(3) For the purpose of determining salary in the calculation of the compensation associated with a job class, the salary at the highest rate in the range of salary rates for positions in the job class is to be used.

Exclusions from compensation

45 An employer — or, if a pay equity committee has been established, that committee — may exclude from the calculation of compensation, with respect to each job class in respect of which compensation is required to be calculated, any form of compensation that is equally available, and provided without discrimination on the basis of gender, in respect of all of those job classes.

Differences in compensation excluded

46 An employer — or, if a pay equity committee has been established, that committee — must exclude from the calculation of compensation associated with a job class any differences in compensation that either increase or decrease compensation in any or all positions in that job class as compared with the compensation that would otherwise be associated with the position, if the differences are based on any one or more of the following factors and those factors have been designed and are applied so as not to discriminate on the basis of gender:

- the existence of a system of compensation that is based on seniority or length of service;

- the practice of temporarily maintaining an employee’s compensation following their reclassification or demotion to a position that has a lower rate of compensation until the rate of compensation for the position is equivalent to or greater than the rate of compensation payable to the employee immediately before the reclassification or demotion;

- a shortage of skilled workers that causes an employer to temporarily increase compensation due to its difficulty in recruiting or retaining employees with the requisite skills for positions in a job class;

- the geographic area in which an employee works;

- the fact that an employee is in an employee development or training program and receives compensation at a rate different than that of an employee doing the same work in a position outside the program;

- the non-receipt of compensation — in the form of benefits that have a monetary value — due to the temporary, casual or seasonal nature of a position;

- the existence of a merit-based compensation plan that is based on a system of formal performance ratings and that has been brought to the attention of the employees; or,

- the provision of compensation for extra-duty services, including compensation for overtime, shift work, being on call, being called back to work and working or travelling on a day that is not a working day.