Comparing compensation – No. 5 Guidance on the use of other methods to compare compensation

Cat. No.: HR4-104/5-2023E-PDF

ISBN: 978-0-660-49643-6

Table of Contents

- 1. Purpose

- 2. Other methods for comparing compensation

- 2.1. What to do if a pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used

- 2.2. What to do if an employer with no pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used

- 3. Information to include in the application

- 4. Referenced Pay Equity Act provisions

1. Purpose

This Interpretation, Policy and Guideline (IPG) covers the following:

- Section 2.1: What to do if a pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used.

- Section 2.2: What to do if an employer with no pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used.

- Section 3.0: What the Pay Equity Commissioner may consider when authorizing the use of another method.

This IPG is the fifth in a series that addresses the comparison of compensation. The other IPGs in this series are:

- No. 1: The Application of the Equal Average Method.

- No. 2: The Application of the Equal Line Method.

- No. 3: What to Do When the Regression Lines Cross: The Modified Version of the Equal Line Method.

- No. 4: What to Do When the Regression Lines Cross: The Equal Average, Segmented Line and Sum of Differences Methods.

This document does not replace expert legal and/or compensation advice. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequitychrc.ca/en.

The term employer in this document can also refer to a group of employers that has been recognized by the Pay Equity Commissioner.i

2. Other methods for comparing compensation

Section 48(1) of the Pay Equity Act (the Act) prescribes that the comparison of compensation must be done using either the equal average method or the equal line method.

However, the Act also outlines that employers or pay equity committees may use other methods should they be of the opinion that neither the equal average method nor the equal line method can be used. See Section 2.1 for what to do if a pay equity committee decides to use another method. See Section 2.2 for what to do if an employer without a pay equity committee decides to use another method.

Both the employer and the pay equity committee must outline why neither the equal average method nor the equal line method was used, describe the method that was used and describe the results of the comparison of compensation in the pay equity plan.ii

Employers and pay equity committees alike may find it helpful to think about the followingiii when making an informed decision about whether to use another method:

- Applicability and transparency: Whether the method suits the needs of the organization and whether it is understood by members of the pay equity committee and employees.

- Arbitrariness: The degree to which the methodology involves arbitrary decisions or results in pay equity adjustments that are clear of ambiguity. The use of the method should be adequately justified.

- Impact on relativities: The degree to which other, non-gender-related, internal inequities in the organization’s compensation structure are undisturbed.

- Residual bias: The degree to which gender-related wage bias is eliminated.

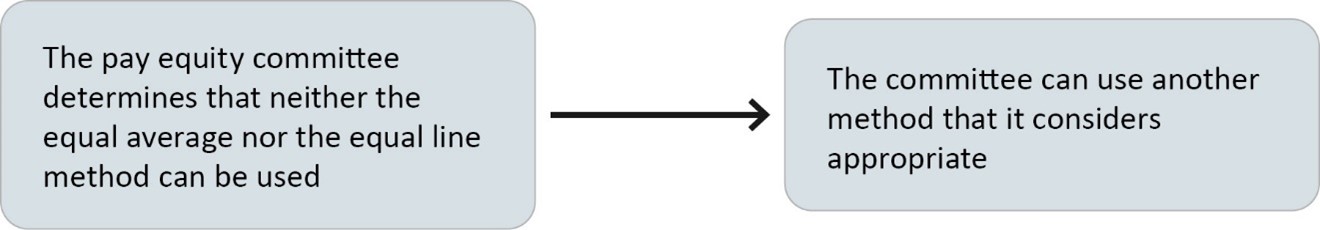

2.1 What to do if a pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used

If a pay equity committee determines that neither the equal average nor the equal line method can be used to compare compensation, it may choose to select a method that it considers appropriate.iv

For guidance on making decisions through collaboration and consensus in a pay equity committee, see the Promising Practices series available on the Publications page.

A pay equity committee that makes this determination does not need to apply to the Commissioner for authorization.

While a pay equity committee does not need to apply to the Commissioner for authorization to use another method, it is important that it keeps all the records, reports, electronic data or other documents that were used to make a decision in this regardv for the purpose of checking compliance through, for example, audits or enforcement.

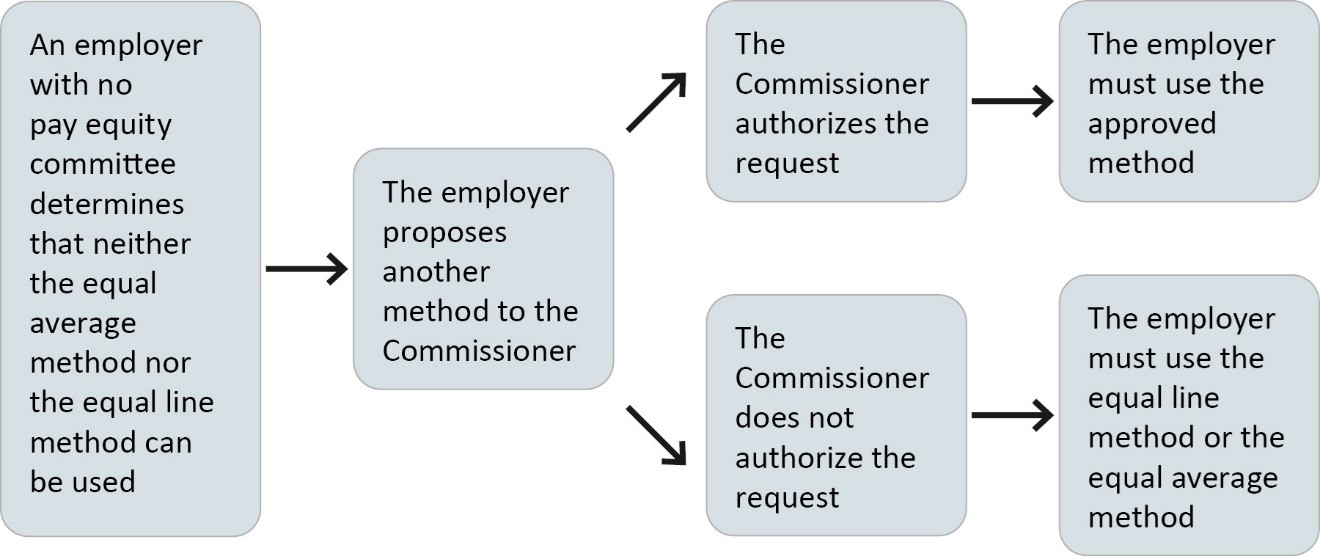

2.2 What to do if an employer with no pay equity committee determines that neither compensation comparison method prescribed in the Pay Equity Act can be used

If an employer with no pay equity committee determines that neither the equal average method nor the equal line method can be used, the employer must apply to the Pay Equity Commissioner for authorization to use a method that it proposes.vi

An employer does not need to make an application to the Pay Equity Commissioner for authorization to use a method outlined in the Pay Equity Regulations (the Regulations) when using the equal line method and the regression lines cross.vii

When making an application to use another method, the employer must demonstrate, through evidence, why they are of the opinion that neither the equal average method nor the equal line method can be used.

An employer does not have to make an application to the Pay Equity Commissioner to use the methods outlined in section 14 of the Regulations that describe what to do should regression lines cross when using the equal line method. Rather, section 14 of the Regulations prescribes the methods that employers must take in these circumstances.

For more information on what to do should regression lines cross, see Comparing Compensation – No. 3: What to Do When the Regression Lines Cross: The Modified Version of the Equal Line Method and Comparing Compensation – No. 4: What to Do When the Regression Lines Cross: The Equal Average, Segmented Line and Sum of Differences Methods.

If the Pay Equity Commissioner approves the request, the employer must use the method the Commissioner authorizes.viii

3. Information to include in the application

Using another method for the comparison of compensation is an exception to the rule. This means that the Pay Equity Commissioner will approve applications only where an employer can demonstrate that the method is appropriate under the circumstances and is consistent with the objective of the Pay Equity Act (the Act), to redress gender-based discrimination in the pay practices and systems of employers.

It is the employer’s responsibility to submit evidence that demonstrates why its application to use another method for the comparison of compensation is appropriate in the circumstances.

In making an application to use another method, the employer should demonstrate that the method it is proposing aligns with the objective of the Act:

- The method is compatible with the objective of the Act;

- It captures the principle of equal pay for work of equal value enshrined in the legislation;

- It is free of gender bias and is non-discriminatory;ix and

- It fulfills and does not contradict all other legislative requirements outlined in the Act, such as those concerning creating job classes, determining the value of work and calculating compensation.

Examples of the types of evidence that could help an employer demonstrate that neither of the prescribed methods for the comparison of compensation can be used include:

- Preliminary calculations using the equal average method and the equal line method, including information that demonstrates why neither is suitable.

- Preliminary calculations using the method proposed by the employer and information that clearly demonstrates how the proposed method rectifies any issues that were identified with using either the equal average method or the equal line method.

- Information that clearly demonstrates how the proposed method meets all the obligations outlined in the Act.

- Information that clearly demonstrates why the proposed method is appropriate under the circumstances.

4. Referenced Pay Equity Act provisions

Group of Employers

4 (1) Two or more employers described in any of paragraphs 3(2)(e) to (i) that are subject to this Act may form a group and apply to the Pay Equity Commissioner to have the group of employers recognized as a single employer.

Compensation comparison methods

48 (1) The comparison of compensation must be made in accordance with the equal average method set out in section 49 or the equal line method set out in section 50.

Other methods

(2) Despite subsection (1),

(a) if an employer determines that neither of the methods referred to in that subsection can be used, the employer must

(i) apply to the Pay Equity Commissioner for authorization to use a method for the comparison of compensation that is prescribed by regulation or, if the regulations do not prescribe a method or the employer is of the opinion that the prescribed method cannot be used, a method that it proposes, and

(ii) use the method for the comparison of compensation that the Pay Equity Commissioner authorizes; and

(b) if a pay equity committee determines that neither of the methods referred to in that subsection can be used, the committee must use a method for the comparison of compensation that is prescribed by regulation or, if the regulations do not prescribe a method or the committee is of the opinion that the prescribed method cannot be used, a method that it considers appropriate.

Crossed regression lines

50(2) Despite paragraphs (1)(b) to (d), if the female regression line crosses the male regression line, an employer or pay equity committee, as the case may be, must apply the rules for the comparison of compensation that are prescribed by regulation.

Contents of plan

51 A pay equity plan must

(a) indicate the number of pay equity plans required to be established in respect of the employer’s employees or, if the employer is in a group of employers, in respect of the employees of the employers in the group;

(b) indicate the number of employees that the employer — or, in the case of a group of employers, each employer in the group — was considered to have for the purpose of determining whether a pay equity committee was required to be established in respect of the pay equity plan;

(c) indicate whether a pay equity committee has been established and, if so, whether it meets the requirements set out in subsection 19(1) or, if not, whether the employer or group of employers, as the case may be, obtained the authorization of the Pay Equity Commissioner to establish a pay equity committee with different requirements;

(d) set out a list of the job classes that have been identified to be job classes of positions occupied or that may be occupied by employees to whom the pay equity plan relates;

(e) indicate whether any job classes referred to in paragraph (d) were determined to be predominantly female job classes and, if so, set out a list of those job classes;

(f) indicate whether any job classes referred to in paragraph (d) were determined to be predominantly male job classes and, if so, set out a list of those job classes;

(g) indicate whether a group of job classes has been treated as a single predominantly female job class and, if so, set out a list of the job classes referred to in paragraph (d) that are included in the group of job classes and identify the individual predominantly female job class within the group that was used for the purpose of subsections 41(3) and 44(2);

(h) if there was a determination of the value of work performed in certain job classes, then, for each of those job classes, describe the method of valuation that was used and set out the results of the valuation;

(i) indicate any job classes in which differences in compensation have been excluded from the calculation of compensation under section 46 and give the reasons why;

(j) if a comparison of compensation was made, indicate which of the methods referred to in subsection 48(1) was used to make the comparison — or, if neither was used, explain why not and describe the method that was used — and set out the results of the comparison;

(k) identify each predominantly female job class that requires an increase in compensation under this Act and describe how the employer — or, in the case of a group of employers, each employer in the group — will increase the compensation in that job class and the amount, in dollars per hour, of the increase;

(l) set out the date on which the increase in compensation, or the first increase, as the case may be, is payable under this Act; and

(m) provide information on the dispute resolution procedures that are available under Part 8 to employees to whom the pay equity plan relates, including any timelines.

Private sector and territorial governments – establishment of pay equity plan

90 (1) An employer referred to in any of paragraphs 3(2)(e) to (i) must

(a) retain a copy of the final version of any pay equity plan that it posts in accordance with section 55, subsection 57(2) or paragraph 94(1)

(b) until the day on which it posts in accordance with section 83 or subsection 85(2) the final version of the pay equity plan as first updated, or any later date that is prescribed by regulation; and (b) retain all records, reports, electronic data or other documents relevant to the establishment of the pay equity plan for the period during which it is required under paragraph (a) to retain a copy of the final version of the pay equity plan.

Authority – other compensation comparison method

111 On receipt of an application referred to in subparagraph 48(2)(a)(i), the Pay Equity Commissioner may, if he or she is of the opinion that it is appropriate in the circumstances, authorize the use of a method for the comparison of compensation that is prescribed by regulation or, if no such method is prescribed or the employer is of the opinion that a method prescribed by regulation cannot be used, the method proposed by the employer.