Definition of employer - Interpretations, Policies and Guidelines

1. Purpose

This document provides interpretive guidance on the term “employer” defined in section 3(2) of the Pay Equity Act (the Act).

This Interpretation, Policy and Guideline covers the following:

- The definition of the term “employer”;

- Criteria that may help identify an employer–employee relationship;

- When an employer becomes a federally regulated employer; and,

- When part of an employer’s operations are federally regulated.

This document is not a legal document and is not a binding interpretation of the Act. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequity.ca.

The Act does not currently apply to employees of the governments of Yukon, the Northwest Territories and Nunavut, or Indigenous governing bodies, including First Nations governments. Pay equity in these workplaces is still protected under section 11 of the Canadian Human Rights Act or territorial legislation.

2. The definition of “employer”

Employers subject to the Pay Equity Act (the Act) are defined in section 3(2) as:

- The Treasury Board, as employer of:

- The core public administration;Footnote 1

- CiviliansFootnote 2 and members of the Royal Canadian Mounted Police;Footnote 3 and,

- The Canadian Forces;Footnote 4

- Each individual separate agency, as employer of its respective workforces;Footnote 5

- A corporation established to perform any duty or function on behalf of the Government of Canada;Footnote 6

- Each person who employs employees in connection with the operation of any federal work, undertaking or business;Footnote 7

- Each person who has a relationship with a dependent contractor that is characterized by economic dependence;Footnote 8 and,

- The governments of Yukon, the Northwest Territories and Nunavut.Footnote 9

The Act is human rights legislation. As such, the term “employer” should be interpreted broadly to ensure the Act applies to all those it is intended to benefit.

Moreover, the term “employer” must be interpreted consistently with the purpose of the Act, which is to redress systemic gender-based discrimination in the compensation practices and systems of federally regulated employers. For example, when trying to determine who the employer is in cases “where one or more employers might possibly be selected, the choice should be the one which best promotes the advancement of pay equity.”Footnote 10

2.1 Federally regulated public sector employers

As per the definition in section 3(2) of the Act, federally regulated public sector employers include:

- The federal government, as set out in Schedules I, IV and V of the Financial Administration Act, including:

- Federal government departments under Schedules I and IV (core public administration);

- The Prime Minister’s Office and other ministers’ offices; and,

- Federal government separate agencies (for example, the Canada Revenue Agency, the National Film Board of Canada and the Canadian Nuclear Safety Commission).

- The Royal Canadian Mounted Police;

- The Canadian Security Intelligence Service; and,

- The Canadian Armed Forces.

The Treasury Board of Canada is the employer of the core public administration, the Royal Canadian Mounted Police, the Canadian Security Intelligence Service and the Canadian Armed Forces. Each separate federal government agency is its own employer.

The Act also applies to parliamentary employers (for example, the Senate, the House of Commons and the Library of Parliament), according to Part II.I of the Parliamentary Employment and Staff Relations Act.

2.2 Federally regulated private sector employers

As per section 3(2) of the Act, federally regulated private employers are persons or organizations that employ people to undertake federally regulated work, as defined in the Canada Labour Code. These employers include:

- Federal Crown corporations (for example, Canada Post and Via Rail); and,

- Private sector employers who hire employees “upon or in connection with the operation of any federal work, undertakings or business.”Footnote 11

Employers that have operations in the following industries are likely required to comply with the Act:

- Banking;

- Navigation and shipping;

- Air transportation;

- Rail transportation;

- Road transportation;

- Canals, pipelines, tunnels and bridges with interprovincial or international activities;

- Telecommunications;

- Postal services;

- Protection of fisheries; and,

- Businesses that are declared by parliament to be “for the general advantage of Canada or for the advantage of two or more of the provinces,”Footnote 12 such as grain elevators, feed and seed mills, and uranium mining and processing.

3. Conditions under which an employer becomes subject to the Pay Equity Act

A few different situations can cause employers and their workplaces to become subject to the Pay Equity Act (the Act), either at the coming into force of the Act or at a later date:

- When a federally regulated employer counts on average 10 or more employees;Footnote 13

- When a provincial business becomes federally regulated;Footnote 14

- When a local employer performs federally regulated work;Footnote 15 and,

- When an employer takes over a federally regulated business.Footnote 16

3.1 When an employer counts on average 10 or more employees

An employee count is done on the basis of the average number of employees working for an employer in a given year—the “reference year.” The employer count determines whether and when an employer is subject to the requirements of the Act.Footnote 17

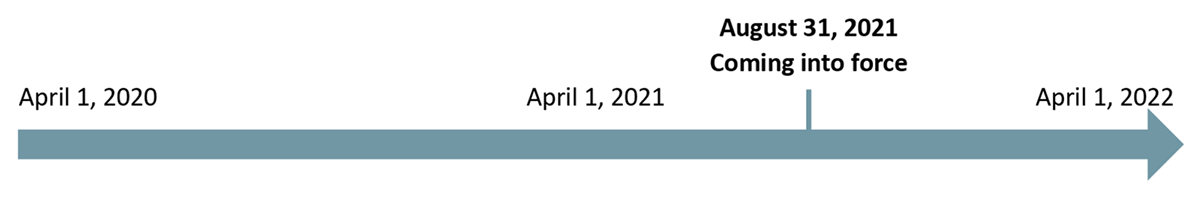

3.1.1 Employee count for public sector employers and parliamentary institutions

Public sector and parliamentary institution employers must count the average number of their employees in the previous fiscal year—April 1 to March 31. If the average number of employees in a given fiscal year increases to 10 or more, the employer will become subject to the Act on April 1 of the next fiscal year.

Reference Year 1 – Employer X counts an average of eight employees employed between April 1, 2020, and March 31, 2021.

Employer X is not subject to the Act at coming into force.

Reference Year 2 – Employer X counts an average of 14 employees employed between April 1, 2021, and March 31, 2022.

Employer X is subject to the Act as of April 1, 2022.

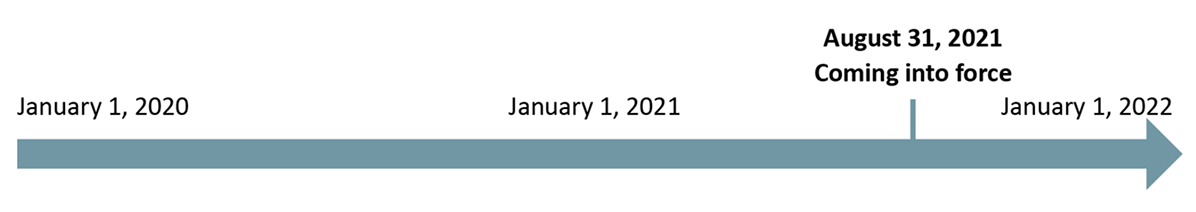

3.1.2 Employee count for private sector employers

Private sector employers must count the average number of their employees in the previous calendar year—January 1 to December 31. If the average number of employees in a given calendar year increases to 10 or more, the employer will become subject to the Act on January 1 of the next calendar year.

Reference Year 1 – Employer X counts an average of eight employees employed between January 1, 2020, and December 31, 2020.

Employer X is not subject to the Act at coming into force.

Reference Year 2 – Employer X counts an average of 14 employees employed between January 1, 2021, and December 31, 2021.

Employer X is subject to the Act as of January 1, 2022.

Employers subject to the Act on the coming into force may refer to Appendix A, which provides key dates associated with their pay equity obligations.

Employers who become subject to the Act after the coming-into-force date of August 31, 2021, may refer to Appendix B to learn about how the key dates of the pay equity process apply to their workplace.

3.2 When a provincial business becomes federally regulated

Provincially regulated employers may become federally regulated and subject to the Act because of changes in the work that they perform. This will occur:

- When their operations become federally regulated; and,

- On the first day of the year after the year their average number of employees reaches 10 or more.

If a newly federally regulated employer was previously a provincially regulated employer in a province that did not require them to establish a pay equity plan, they must meet all the same obligations as other employers under the Act.

However, a newly federally regulated employer will have less time to complete all of the steps to develop a pay equity plan if they:

- Were previously a provincially regulated employer in a province that did require them to establish a pay equity plan; or,

- Became a federally regulated workplace at least 18 months after the day the Act came into force.Footnote 18

An employer who meets either of these two criteria must post the final version of their pay equity plan no later than 18 months after the day they became subject to the Act, instead of three years.

Employers in this situation are given less time because they have already completed a pay equity plan.

In March 2022, Trucking Company A expands its operations to interprovincial and international transportation. The new activities are fully integrated into Trucking Company A’s operations. Therefore, as of March 2022, Trucking Company A’s business falls within the federal jurisdiction, and as a result, Trucking Company A will become subject to the Pay Equity Act.

3.3 When a local employer performs federally regulated work Footnote 19

In certain cases, a business may operate in two or more distinct sectors or may have two or more areas of activity.

The labour relations of such a business may be regulated by provincial or federal laws, or both.

In cases where only part of an employer’s operations are federally regulated, there are two circumstances in which an employer may become subject to the Act:

- The federally regulated work is integral to the employer’s operations and forms a significant part of its overall operations; Footnote 20 or,

- The federally regulated activities are performed by employees that form a separate and distinct unit, severable from the rest of the employer’s operations. Footnote 21

If one of these two circumstances apply to your business, legal advice may be required.

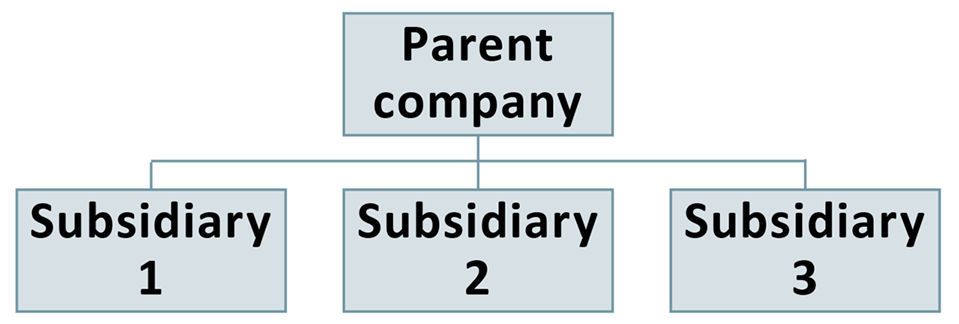

3.3.1 The case of parent companies and subsidiaries

Corporate structures take many different and complex forms. Some businesses are organized into distinct divisions, while still operating as a single legal entity.

In other instances, the distinct divisions or areas of activities will be organized through separate companies. These separate companies, or subsidiaries, may be owned in whole or in part by another company (the parent company) that helps unify and coordinate their various operations.

Some subsidiaries under the parent company may carry out federal undertakings, while others may perform work that is regulated by provincial laws. The subsidiaries may operate in different industries while those that operate in the same industry may be performing totally different work. Yet another may simply be a holding company.

When each subsidiary and the parent company are separate legal entities, each separate entity will typically be considered a distinct “employer” for pay equity purposes. However, there may be cases in which separate legal entities are considered a common employer.

In this image, the parent company, subsidiary 1, subsidiary 2 and subsidiary 3 are considered to be distinct employers. This means that the parent company and each subsidiary are expected to conduct their own pay equity process and create their own pay equity plan.

In this example, if the parent company, subsidiary 1, subsidiary 2 and subsidiary 3 wish to be treated as a single employer, they would need to make an application to be recognized as a group of employers. In this application, they would need to demonstrate that they meet the following criteria as per the Act:

- They are part of the same industry;Footnote 22

- They have similar compensation practices;Footnote 23 and,

- They have positions with similar duties and responsibilities.Footnote 24

In other words, a group consisting of a parent company and multiple subsidiaries that are separate legal entities and distinct employers do not need to apply for authorization to create multiple pay equity plans. Instead, they are each required to develop their own pay equity plan unless they obtain the Pay Equity Commissioner’s authorization for the group of companies to be recognized as a single employer.

For more information about the authorization request process to be recognized as a group of employers and the application for multiple pay equity plans please consult our Interpretations, Policies and Guidelines on Group of Employers and Multiple Plans available at: https://www.payequitychrc.ca/en/publications.

3.4 When an employer takes over a federally regulated business

Once a federally regulated private sector or Crown corporation employer has posted a final pay equity plan, that plan continues to apply even when a new employer takes over the business or organization through:

- A transfer or lease (either through sale or merger);Footnote 25 or,

- Contract retendering.Footnote 26

In these situations, the new employer becomes:

- Subject to the Act, if they were not already;Footnote 27

- Liable for the former employer’s obligations under the Act resulting from the posting of the final pay equity plan;Footnote 28 and,

- Considered to be the employer that posted the plan going forward.Footnote 29

In other words, the new employer picks up where the former employer left off. This means the new employer must continue paying the new salaries for any employees who were owed an increase in compensation and maintain pay equity for its employees going forward.

Example

XYZ Telecommunications (XYZ) has 65 employees and has been subject to the Pay Equity Act since its coming into force on August 31, 2021.

In 2025, the federally regulated telecommunications company STU wins a tender launched by XYZ and integrates XYZ’s 65 employees into its operations. Due to contract retendering, STU is now considered to be the employer of XYZ’s former employees and is responsible for XYZ’s pay equity obligations.

4. Factors and criteria for determining who the employer is in different circumstances

The Act does not provide criteria for determining an employment relationship between two parties. Nor does it provide factors to consider in identifying who the “true employer” is in a situation where there are several potential employers, such as the four situations discussed above. Since the common law is not excluded by the Act, common law criteria and factors on these matters continue to apply.Footnote 30

4.1 Identifying the employer in a tripartite relationship

In some cases it is not clear who the employer is, due to a tripartite employment relationship.

In the leading case dealing with tripartite employment relationships, Pointe-Claire (City) v. Quebec (Labour Court),Footnote 31 the court stated that a "comprehensive and flexible" approach should be used to determine the issue.

Factors identified by the court that may be helpful to consider when trying to determine the employer in a tripartite employment relationship include:

- Day-to-day control over the work done;

- The selection process and hiring;

- Discipline, training and evaluation;

- Compensation and assignment of duties;

- Integration into the business;

- Employees' sense of belonging; and,

- The length of time the services are provided.Footnote 32

Similar factors that may be helpful to consider when trying to determine the employer in a tripartite employment relationship include those identified by the Canada Industrial Relations Board in Nationair (Nolisair International Inc.) (Re)Footnote 33:

- Who ultimately bears the cost, and what impact does this have on the employment relationship?

Consider which party takes on the responsibility of payment and remuneration. - Who controls access to employment? Consider who hires or who gives the work to be performed. Regard must be given to the selection process and the criteria used. The party who has the power to approve the selection and influence it decisively is more akin to an employer than a mere occasional user.

- Who is in charge of establishing the working conditions? Consider who actually establishes working conditions. For example, an agency that is disguised as an employment office, a kind of clearing house with a title, is unlikely to be the employer.

- Who oversees the performance of the work?

Consider:- How the work is performed on a day-to-day basis;

- Who assigns the work;

- Who determines and approves the standards governing the performance of the work. For instance, who has the last word or the final say;

- Who evaluates, decides or determines whether an employee will work or be terminated based on performance;

- Whether the agency has expertise with respect to the work performed; and,

- The degree of similarity between the duties performed by regular employees and those performed by employees from outside.

- Who do the employees perceive as the employer?

Consider how the employee identifies with the company, their degree of integration into the company, the fortuitous, temporary or permanent nature of their employment with the leasing company.

While these factors are helpful, they can only be considered guidelines, as the identity of the real employer is determined by the facts on a case-by-case basis, with no single factor being determinative in itself. Footnote 34

5. Other criteria that may be considered

Beyond the criteria set out in the case law, employers may use some of the questions and sub-questions set out in Appendix C to consider who the real employer is and how the Pay Equity Act applies to their particular circumstances.

6. Referenced Pay Equity Act Provisions

Interpretation

Definitions

3(1) The following definitions apply in this Act.

[…]

Employers

(2) For the purposes of this Act, each of the following is considered to be an employer:

- Her Majesty in right of Canada as represented by the Treasury Board, in respect of the aggregate of the departments and other portions of the federal public administration named in Schedules I and IV, respectively, to the Financial Administration Act, except that the reference to the Royal Canadian Mounted Police in that Schedule IV is deemed to be a reference to the Royal Canadian Mounted Police only in respect of civilian employees appointed or employed in accordance with section 10 of the Royal Canadian Mounted Police Act;

- Her Majesty in right of Canada as represented by the Treasury Board, in respect of the Canadian Forces;

- Her Majesty in right of Canada as represented by the Treasury Board, in respect of the Royal Canadian Mounted Police, in relation to members as defined in subsection 2(1) of the Royal Canadian Mounted Police Act;

- in respect of a separate agency, as defined in subsection 11(1) of the Financial Administration Act, Her Majesty in right of Canada as represented by the separate agency;

- each person who employs employees in connection with the operation of any federal work, undertaking or business, as defined in section 2 of the Canada Labour Code, other than a work, undertaking or business of a local or private nature in Yukon, the Northwest Territories or Nunavut;

(e.1) a corporation established to perform any duty or function on behalf of the Government of Canada, other than a corporation named in Schedule IV or V of the Financial Administration Act; - in respect of a dependent contractor, an employer as defined in paragraph (b) of that expression in subsection 3(1) of the Canada Labour Code;

- the government of Yukon;

- the government of the Northwest Territories; and

- the government of Nunavut.

Application

Employers subject to Act on coming into force

6 The following employers become subject to this Act on the date on which this section comes into force:

- an employer referred to in any of paragraphs 3(2)(a) to (d) that

- is considered under subparagraph 8(a)(i) to have 10 to 99 employees, or

- is considered under subparagraph 8(b)(i) to have 100 or more employees; and

- an employer referred to in any of paragraphs 3(2)(e) to (i) that

- is considered under subparagraph 9(a)(i) to have 10 to 99 employees, or

- is considered under subparagraph 9(b)(i) to have 100 or more employees.

Determination of number of employees — public sector

8 For the purpose of sections 6 and 7

- an employer referred to in any of paragraphs 3(2)(a) to (d) is considered to have 10 to 99 employees if

- the average of the number of the employer’s employees in the fiscal year immediately before the fiscal year in which this section comes into force is at least 10 but less than 100, or

- the average of the number of the employer’s employees in the fiscal year in which this section comes into force or in any subsequent fiscal year is at least 10 but less than 100; and

- an employer referred to in any of paragraphs 3(2)(a) to (d) is considered to have 100 or more employees if

- the average of the number of the employer’s employees in the fiscal year immediately before the fiscal year in which this section comes into force is 100 or more, or

- the average of the number of the employer’s employees in the fiscal year in which this section comes into force or in any subsequent fiscal year is 100 or more.

Determination of number of employees — private sector and territorial governments

9 For the purpose of sections 6 and 7

- an employer referred to in any of paragraphs 3(2)(e) to (i) is considered to have 10 to 99 employees if

- the average of the number of the employer’s employees in the calendar year immediately before the calendar year in which this section comes into force is at least 10 but less than 100, or

- the average of the number of the employer’s employees in the calendar year in which this section comes into force or in any subsequent calendar year is at least 10 but less than 100; and

- an employer referred to in any of paragraphs 3(2)(e) to (i) is considered to have 100 or more employees if

- the average of the number of the employer’s employees in the calendar year immediately before the calendar year in which this section comes into force is 100 or more, or

- the average of the number of the employer’s employees in the calendar year in which this section comes into force or in any subsequent calendar year is 100 or more.

Transfers or Leases

Federal private sector — transfer or lease

92 If a federal work, undertaking or business, as defined in section 2 of the Canada Labour Code, or any part of it — or a corporation established to perform any duty or function on behalf of the Government of Canada, or any part of the corporation, other than a corporation named in Schedule IV or V of the Financial Administration Act — is leased or transferred by sale, merger or otherwise from one employer, in this section referred to as the “former employer”, to another employer, in this section referred to as the “new employer”, and the former employer had posted, or is deemed to be the employer that had posted, as the case may be, a pay equity plan in accordance with section 55, subsection 57(2), section 83 or subsection 85(2),

- the new employer is deemed to be the employer that posted the pay equity plan;

- the new employer is liable for the former employer’s obligations under this Act that arose as a result of the posting of the pay equity plan; and

- if the new employer was not subject to this Act immediately before the day of the transfer or lease, it becomes subject to this Act on that day.

Federal private sector — re-tendering

93 If, by reason of a contract being awarded through a re-tendering process, an employer, in this section referred to as the “new employer”, becomes responsible for the carrying out or the operation of a federal work, undertaking or business, as defined in section 2 of the Canada Labour Code, or any part of it, that was previously carried out or operated by another employer, in this section referred to as the “former employer”, and the former employer had posted, or is deemed to be the employer that had posted, as the case may be, a pay equity plan in accordance with section 55, subsection 57(2), section 83 or subsection 85(2),

- the new employer is deemed to be the employer that posted the pay equity plan;

- the new employer is liable for the former employer’s obligations under this Act that arose as a result of the posting of the pay equity plan; and

- if the new employer was not subject to this Act immediately before the day on which the contract becomes effective, it becomes subject to this Act on that day.

Provincial business

94 (1) If, after the coming into force of this section, a person that carries out or operates a provincial business becomes an employer referred to in any of paragraphs 3(2)(e) to (i), and the person was, while carrying out or operating the provincial business, required to establish a pay equity plan under the laws of a province,

- for the purpose of calculating, under subparagraph 9(a)(ii) or (b)(ii), the average of the number of the employer’s employees in the calendar year in which the person becomes an employer, the persons who were employed in the provincial business in that calendar year are deemed to have been employees of that employer in that calendar year; and

- if the employer becomes subject to this Act on a day that is on or after the day that is 18 months after the date on which this section comes into force, the employer must, despite subsection 55(1), post the final version of the pay equity plan no later than the day that is 18 months after the date on which the employer became subject to this Act.

Authorizations by Pay Equity Commissioner

Recognition of group as single employer

106 (1) On receipt of an application referred to in subsection 4(1), the Pay Equity Commissioner may recognize the group as a single employer if he or she is of the opinion that the employers

- are part of the same industry;

- have similar compensation practices; and

- have positions with similar duties and responsibilities.

Appendix A

Key pay equity dates for employers who become subject to the Act on the coming-into-force date of August 31, 2021:

| Key pay equity date | 10 to 99 employees on average between April 1, 2020, and March 31, 2021 | 100 or more employees on average between April 1, 2020, and March 31, 2021 |

|---|---|---|

| Post Pay Equity Act notice by | November 1, 2021 | November 1, 2021 |

| Post final pay equity plan by | September 3, 2024 | September 3, 2024 |

| First pay equity adjustments due | September 4, 2024 | September 4, 2024 |

| Phase in increases by | September 4, 2029 | September 1, 2027 |

| Post revised pay equity plan no later than | September 4, 2029 | September 4, 2029 |

| First annual statement no later than | June 30, 2025 | June 30, 2025 |

| Key pay equity date | 10 to 99 employees on average between January 1, 2020, and December 31, 2021 | 100 or more employees on average between January 1, 2020, and December 31, 2021 |

|---|---|---|

| Post Pay Equity Act notice by | November 1, 2021 | November 1, 2021 |

| Post final pay equity plan by | September 3, 2024 | September 3, 2024 |

| First pay equity adjustments due | September 4, 2024 | September 4, 2024 |

| Phase in increases by | September 4, 2029 | September 1, 2027 |

| Post revised pay equity plan no later than | September 4, 2029 | September 4, 2029 |

| First annual statement no later than | June 30, 2025 | June 30, 2025 |

Appendix B

Key pay equity dates for employers who become subject to the Act after the coming-into-force date of August 31, 2021:

| Key pay equity date | 10 to 99 employees on average between April 1 and March 31 of any year following fiscal year 2020–2021 | 100 or more employees on average between April 1 and March 31 of any year following fiscal year 2020–2021 |

|---|---|---|

| Become subject to the Pay Equity Act on | April 1 of the year after the fiscal year in which the average number of employees was between 10 and 99 | April 1 of the year after the fiscal year in which the average number of employees was 100 or more |

| Post Pay Equity Act notice by | 60 days after becoming subject to the Act | 60 days after becoming subject to the Act |

| Post final pay equity plan by | Three years after becoming subject to the Act | Three years after becoming subject to the Act |

| First pay equity adjustments due | The day after posting the final pay equity plan | The day after posting the final pay equity plan |

| Phase in increases by | The day after the eighth anniversary of the date on which the employer became subject to the Act | The day after the sixth anniversary of the date on which the employer became subject to the Act |

| Post revised pay equity plan no later than | The fifth anniversary of the day on which the employer posted the final pay equity plan | The fifth anniversary of the day on which the employer posted the final pay equity plan |

| First annual statement no later than | June 30 of the calendar year after the employer has posted the final pay equity plan | June 30 of the calendar year after the employer has posted the final pay equity plan |

| Key pay equity date | 10 to 99 between January 1 and December 31 of any year following calendar year 2020 | 100 or more between January 1 and December 31 of any year following calendar year 2020 |

|---|---|---|

| Become subject to the Pay Equity Act on | January 1 of the year after the calendar year in which the average number of employees was between 10 and 99 | January 1 of the year after the calendar year in which the average number of employees was 100 or more |

| Post Pay Equity Act notice by | 60 days after becoming subject to the Act | 60 days after becoming subject to the Act |

| Post final pay equity plan by | Three years after becoming subject to the Act | Three years after becoming subject to the Act |

| First pay equity adjustments due | The day after posting the final pay equity plan | The day after posting the final pay equity plan |

| Phase in increases by | The day after the eighth anniversary of the date on which the employer became subject to the Act | The day after the sixth anniversary of the date on which the employer became subject to the Act |

| Post revised pay equity plan no later than | The fifth anniversary of the day on which the employer posted the final pay equity plan | The fifth anniversary of the day on which the employer posted the final pay equity plan |

| First annual statement no later than | June 30 of the calendar year after the employer has posted the final pay equity plan | June 30 of the calendar year after the employer has posted the final pay equity plan |

Appendix C

The questions provided below may be considered as guidelines to help employers and/or pay committees determine who the real employer is.

Other questions that are not listed here may be relevant. The content of the questions must be adapted for each case.

Questions to assist in determining the real employer

- What is the business activity carried out by each entity?

- What is the purpose of the entity?

- What is the mission or vocation of the entity?

- What goods are produced?

- What services are offered?

- To which market segment is the good or service offered?

- How are the production resources of each entity organized?

- Where are the different resources physically located?

- How are the entity’s production resources organized?

- How are the resources coordinated or organized to carry out the business activity?

- What are the entity’s material, technical and human resources? How and by whom are they managed?

- Does the entity have real autonomy of production and control of its operations?

- Are the entities owned by the same natural or legal persons?

- Are they separate corporate entities?

- Do the entities have the same business activities?

- Are the activities of each entity well defined?

- Do physical and technical resources have a separate accounting?

- Do the entities have separate human resources departments?

- Under what conditions can an employee work for another entity? Do they have to resign?

- Are strategic decisions made for all entities indiscriminately or for each entity individually?