Calculation of Compensation – No. 5 Guidance concerning the calculation of different types of incentive pay

1. Purpose

This Interpretation, Policy and Guideline (IPG) provides guidance on how to:

- Identify and define different types of incentive pay; and,

- Calculate different types of incentive pay for the purposes of pay equity.

This IPG is the fifth in a series that addresses the calculation of compensation. The other IPGs in this series are:

- No. 1: Guidance Concerning the Definition of Compensation.

- No. 2: Exclusions.

- No. 3: An Interpretation of Salary and Determining the Highest Salary Rate.

- No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay.

- No. 6: Guidance Concerning the Calculation of Indirect Compensation Elements.

This document does not replace expert legal and/or compensation expertise and advice. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequitychrc.ca/en.

The term employer in this document can also refer to a group of employers that has been recognized by the Pay Equity Commissioner.i

2. Definition of compensation

Section 3(1) of the Pay Equity Act defines compensation as any form of remuneration payable for work performed by an employee, including:

- Salaries, commissions, vacation pay, severance pay and bonuses;

- Payments in kind;

- Employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and,

- Any other advantage received directly or indirectly from the employer.

For more information, see Calculation of Compensation – No. 1: Guidance Concerning the Definition of Compensation on the pay equity publications web page: https://www.payequitychrc.ca/en/publications.

3. Guidance on identifying and calculating different types of incentive pay

The following sections provide guidance on how to define and calculate different types of incentive pay when determining the total compensation of a job class.

3.1. Identifying incentive pay

Different types of incentive pay can be identified and included as a direct compensation element in the total compensation model.

Examples of incentive pay include:

- Individual or team-based bonus or incentive plans covering a specified time period, typically up to one year for many employees and job classes—for example, an annual short-term incentive (STI) plan;

- Long-term incentives (LTIs)—for example, a stock option program and/or performance share units; and,

- Profit or gain sharing.

Incentive pay is a form of compensation that is variable—not fixed—and where at-risk/performance-based rewards are directly tied to individual, team and/or organizational success, both financially (for example, revenue growth and profit margins) and non-financially (for example, customer satisfaction and employee engagement—as measured, for example, through balanced scorecard targets).

Incentive compensation plans are primarily used to promote efficiency and/or outcome aspirations, but they may also be used to enhance employee recruitment, engagement and retention, and employer branding.ii In addition, incentive plans are increasingly being used to link employee rewards to social, environmental, wellness/health and safety aspirations and targets.

As a guiding principle, incentive pay target amounts by job class should be included in the calculation of compensation. Incentive pay amounts received for above-target performance may be excluded if they meet the criteria under section 46 of the Pay Equity Act (the Act).

To determine amounts, the employer or pay equity committee may choose to use the median or average pay amounts earned at target levels of performance by all positions in the job class for the purpose of calculating total compensation.

3.2. Calculating incentive pay amounts for pay equity

If incentives are to be included in the calculation of total compensation for the job class, one option for determining the amount is to focus on what best represents the actual earnings received by the job class as a whole. Where there are targets for a job class, these amounts may be used. In situations where these targets do not exist, the employer or pay equity committee may calculate amounts using the realized median or average. It may be helpful to seek the advice of an expert, as there are advantages and disadvantages to using either approach.

For the purposes of pay equity, there is a need to distinguish between amounts that an employee can expect to receive for meeting target performance standards and those amounts that are truly at risk and are contingent on delivering above-target levels of performance:

- Any amounts that an employee expects to receive (for example, by meeting threshold or target performance standards) should be included in the calculation of total compensation.

- Any amounts that an employee is eligible to receive, based on established performance management practices, for above-target levels of performance should be included in the calculation of total compensation if they do not meet the exclusion criteria outlined in section 46 of the Act.

3.2.1. Short-term incentive (STI) compensation

At risk, short-term performance-based incentive rewards are typically planned, measured and rewarded on an annual basis in alignment with one’s fiscal or performance year. They are typically cash based, as a percent of base salary (for example, a 10% STI reward for meeting planned target performance expectations).

| Performance level | STI reward | Guidance |

|---|---|---|

| Meets threshold performance | 7.5% | Inclusion if target levels are generally not achieved* |

| Meets performance targets | 10.0% | Included in calculation of total compensation for pay equity |

| Exceeds performance targets | 12.5% | Possible section 46 exclusion of 2.5% |

*For those circumstances where only threshold performance is met and target performance rewards are not achieved, average (for example, over a three year period to take into account in-year anomalies) STI amounts for the job class may be used for pay equity purposes.

3.2.2. Employee share purchase plan (ESPP)

An ESPP is a formalized company-run program in which eligible employees can purchase company stock at a discounted price. Employees contribute to the plan through payroll deductions, which build up between the offering date and the purchase date. At the purchase date, the company uses the employee’s accumulated fundsiii to purchase stock in the company on behalf of the participating employees.iv

To value for the purposes of pay equity, include the average or median amount of the employer-paid contribution discount per share (or using another pre-established and formally recognized valuation methodology). The employer’s average discounted employee share purchase plan allocation by job class must be annualized and included in the calculation of total compensation for pay equity purposes.

3.2.3. Profit-sharing plan (PSP)

A profit-sharing plan is a formalized and prescriptive plan providing for employee participation in the profit realization of an organization in those instances where threshold and/or target levels of enterprise-wide operational profitability are met. The plan normally includes a predetermined and defined formula for allocating a proportion of profit over and above prescribed targets among participants and for distributing funds accumulated under the plan. However, some plans are discretionary. Funds may be distributed in cash, deferred as a qualified retirement program or distributed in a cash-and-deferred combination.v

To value for the purposes of pay equity, take an average of the variable profit-sharing reward, annualize the amount and then convert it to an hourly rate.

Scenario: Incumbents in job class A received an average profit-sharing reward of $2,500 each year over the past three years.

Calculation: The employer or pay equity committee may take the annualized amount and convert it to an hourly rate.

Assuming a 40-hour work week, this equates to $1.20/hour.

$2,500 ÷ 52 weeks ÷ 40 hours = $1.20/hour

Conclusion: For the purposes of pay equity, the employer or pay equity committee would add $1.20 to the calculation of compensation for the job class.

3.2.4. Gain-sharing plans

Gain-sharing plans are team-based incentive programs designed to share the outcomes of productivity gains for a business unit or the broader enterprise. They are formalized and prescriptive variable pay plans that reward employees for enterprise-wide productivity or cost-reduction realization relative to predetermined threshold targets. Gain-sharing plans are typically not individually based, but rather team based. The amount paid is usually determined through a predetermined formula.vi

For pay equity purposes, the amount offered to employees should be converted to an hourly rate for the calculation of total compensation for the job class.

Scenario: Incumbents in job class B received an average gain-sharing reward of $3,000 each year over the past three years.

Calculation: The employer or pay equity committee would take the annualized amount and convert it to an hourly rate.

Assuming a 40-hour work week, this equates to $1.44/hour.

$3,000 ÷ 52 weeks ÷ 40 hours = $1.44/hour

Conclusion: For the purposes of pay equity, the employer or pay equity committee would add $1.44 to the calculation of compensation for the job class.

3.2.5. Other types of incentive plans: Deferred bonus and bonus banking

Some organizations may offer total compensation strategies that include unique incentive plans or variations on core incentive programs such as bonus banking and/or deferred STI rewards.

Bonus banking and/or deferred STI rewards are generally built on annual performance management or cash incentive plans. They require the employee to bank or defer some portion of an in-year or annual cash reward, with actual payment based on longer-term retention and/or established performance criteria. Other variations may also include the use of annual STI cash rewards, or portions thereof, to fund various types of retirement savings plans.

Where offered, these types of programs are typically focused on executive and managerial job classes. Generally, the aggregate STI annual amount or cash reward, before deferral, would be used for pay equity calculation purposes (please see Section 3.2.1). If, however, an employer wants to formally recognize the deferral or bonus banking plan and discount the current-year STI reward by the amount of the deferral, then the employer would be required to determine the future deferral value based on the defined plan and valuation methodology and include that amount in the pay equity calculation.

Amounts received for exceeding prescribed target performance standards must be included in the calculation of total compensation for the job class if they do not meet the exclusion criteria outlined in section 46 of the Act.

3.3. Long-term incentive (LTI) compensation

LTI compensation is defined as a performance-based incentive reward that is linked and calibrated to strategic long-term performance targets with a duration of generally three years for non-equity-based incentive rewards and three to ten years for equity-based incentive rewards.

LTI compensation practices vary widely and may consist of both non-equity-based and equity-based incentive rewards.

Non-equity versus equity LTI compensation

Non-equity-based incentive rewards are typically variable cash compensation payments (for example, percent of base pay) linked to specific longer-term (generally three years in duration) enterprise and/or team performance targets.

Equity-based incentive rewards are generally non-cash compensation that are offered to employees and may include stock options, restricted stock and/or performance shares.

LTI rewards are typically used as a core dimension of executive compensation but in some cases can be used as a component of total compensation for other employees. The following descriptions and examples provide summary insights on non-equity and equity LTIs and suggested approaches for including them in the calculation of total compensation for the purposes of pay equity.

3.3.1. Non-equity long-term cash rewards

Non-equity long-term cash rewards may be expressed as a percent of an employee’s base pay. For example, a non-equity long-term cash reward could be 30% of an employee’s base pay and paid three years in the future if predetermined enterprise-wide team and/or individual thresholds and/or target performance outcomes are achieved.

If the amount of the non-equity long-term cash reward is received for meeting prescribed thresholds and/or up to target performance standards, the amount needs to be annualized and included in the calculation of total compensation for the job class.

Non-equity long-term cash reward amounts received for exceeding prescribed thresholds and/or performance standards must be annualized and included in the calculation of total compensation for the job class if they do not meet the exclusion criteria outlined in section 46 of the Act.

Different scenarios and approaches for calculating non-equity long-term cash reward amounts for the purposes of pay equity can be found in the appendix.

3.3.2. Equity-based long-term incentives (LTIs)

Equity-based LTI rewards are non-cash incentive compensation rewards typically in the form of company shares (stocks) or equity-like share or stock units that are generally offered to specific levels or segments of employees (for example, the executive group). Equity-based incentive rewards can take many forms, including stock options, restricted stock or share units (RSUs) and performance share units (PSUs).

The information provided below provides an overview of different equity-based LTI plan types.

Scenarios and examples for how to calculate amounts for the purposes of pay equity can be found in the appendix.

A. Stock optionsvii

Stock options offer the employee (grantee) the right to purchase the shares of a company at a fixed price, known as the exercise price, at some point in the future based on the defined vesting schedule and time-based term of duration. Generally, the stock option’s exercise price will be the stock’s closing price on the date of the grant.

Once a stock option vests, the grantee can exercise the right to purchase stock at the exercise price.

About vestingviii

A vesting period means that grantees are conditionally granted equity, but they do not actually own the right to exercise the option until the vesting period expires (for example, 25% of the option grant vests per year, with full vesting at the end of four years). A vesting period is also generally tied to vesting requirements. These can include, for example, staying with a company for a set period of time or meeting performance goals. If the grantee does not meet these vesting requirements, they forfeit the grant.

There are also two types of vesting: ratable and cliff vesting. Stock option awards that vest ratably vest a prescribed portion at a time—the predominant practice observed for most organizations. If an employee terminates their employment prior to the end of the final vesting period, the employee still owns the portion that has vested. Awards that cliff vest are paid out all at once, at the conclusion of a predetermined time period.

While a number of stock option granting programs are prevalent in workplaces, a few generalizations can be made:

- In all cases, the grant amount or value will need to be annualized for pay equity purposes.

- In all cases, the initial reference point should be the stock option plan’s prescribed grant and vesting methodology, typically based on defined classification levels and related job-specific grant values.

- In all cases, an agreed-upon grant valuation methodology, such as a Black-Scholesix grant valuation, must be used to calculate and estimate the amounts for pay equity total compensation determination.

- Given the unpredictable long-term essence of stock options and stock market performance, the realized amount or value if and when the stock options are exercised at some point in the future should not be used for the purposes of pay equity.

Scenarios that describe approaches that may be applied for calculating amounts to be used for the purposes of pay equity can be found in the appendix.

B. Restricted stock or share units (RSUs)

RSUs are a type of LTI compensation issued by an employer to an employee in the form of retention-based company shares or share-equivalent units. Based on a prescribed number of RSU units, RSUs are intended to incent employee retention and are payable when the retention milestone is achieved (typically three years into the future). Upon vesting (when the milestone retention date is achieved), RSUs give employees interest in company stock or equivalent share units based on a fair market value when they vest. RSUs are typically taxed as income, with the residual RSU reward being settled as shares, share-equivalent units and/or cash.

RSUs are generally offered to executives, senior management and occasionally middle management.

Where dividend entitlements are attached to an RSU, the employer’s methodology for valuation should be used, as long as it is consistent and equally applied to all positions within a job class.

Since RSUs are typically based on a defined long-term timeline (typically three years), if applicable, dividend income linked to vested or earned RSUs should not be included in the calculation of total compensation for a job class, as it is already included in the cost of the stock. Scenarios that describe approaches that may be applied for calculating amounts to be used for the purposes of pay equity can be found in the appendix.

C. Performance share units (PSUs)

PSUs are conceptually similar to RSUs, but PSU grants and incentive criteria are based on meeting prescribed and formally measured enterprise-wide, longer-term performance-based targets—typically three years into the future.x

There may be instances where formally measured above-target (or outstanding) individual performance results are used to provide for incremental PSU grants. In these cases, such amounts must be excluded from the calculation of total compensation for the job class if they meet the exclusion criteria in section 46 of the Act.

PSUs are generally offered to executives, senior management and occasionally middle management.

Where dividend entitlements are attached to a PSU, the employer’s methodology for valuation should be used, as long as it is consistent and equally applied to all positions within a job class.

Since PSUs are typically based on a defined long-term timeline (typically three years), if applicable, dividend income linked to vested or earned PSUs should not be included in the calculation of total compensation for a job class, as it is already included in the cost of the stock.

Scenarios that describe approaches that may be applied for calculating amounts to be used for pay equity purposes can be found in the appendix.

4. Referenced Pay Equity Act provisions

3(1)

compensation means any form of remuneration payable for work performed by an employee and includes

- salaries, commissions, vacation pay, severance pay and bonuses;

- payments in kind;

- employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and

- any other advantage received directly or indirectly from the employer. (rémunération)

Calculation

44 (1) An employer — or, if a pay equity committee has been established, that committee — must calculate the compensation, expressed in dollars per hour, associated with each job class for which it has determined, under section 41, the value of the work performed.

Group of job classes

(2) If an employer or pay equity committee, as the case may be, treats a group of job classes as a predominantly female job class in accordance with section 38, the compensation associated with that job class is considered to be the compensation associated with the individual predominantly female job class within the group that has the greatest number of employees.

Salary

(3) For the purpose of determining salary in the calculation of the compensation associated with a job class, the salary at the highest rate in the range of salary rates for positions in the job class is to be used.

Exclusions from compensation

45 An employer — or, if a pay equity committee has been established, that committee — may exclude from the calculation of compensation, with respect to each job class in respect of which compensation is required to be calculated, any form of compensation that is equally available, and provided without discrimination on the basis of gender, in respect of all of those job classes.

Differences in compensation excluded

46 An employer — or, if a pay equity committee has been established, that committee — must exclude from the calculation of compensation associated with a job class any differences in compensation that either increase or decrease compensation in any or all positions in that job class as compared with the compensation that would otherwise be associated with the position, if the differences are based on any one or more of the following factors and those factors have been designed and are applied so as not to discriminate on the basis of gender:

- the existence of a system of compensation that is based on seniority or length of service;

- the practice of temporarily maintaining an employee’s compensation following their reclassification or demotion to a position that has a lower rate of compensation until the rate of compensation for the position is equivalent to or greater than the rate of compensation payable to the employee immediately before the reclassification or demotion;

- a shortage of skilled workers that causes an employer to temporarily increase compensation due to its difficulty in recruiting or retaining employees with the requisite skills for positions in a job class;

- the geographic area in which an employee works;

- the fact that an employee is in an employee development or training program and receives compensation at a rate different than that of an employee doing the same work in a position outside the program;

- the non-receipt of compensation — in the form of benefits that have a monetary value — due to the temporary, casual or seasonal nature of a position;

- the existence of a merit-based compensation plan that is based on a system of formal performance ratings and that has been brought to the attention of the employees; or

- the provision of compensation for extra-duty services, including compensation for overtime, shift work, being on call, being called back to work and working or travelling on a day that is not a working day.

Appendix

If incentive programs do not have prescribed methods, standards and/or target amounts, the following calculations may be helpful for employers or pay equity committees. The calculations outlined in the scenarios provided below are examples and are not mandatory. It is up to the workplace parties to discuss together how they wish to adopt an approach that works for them while at the same time advancing the purposes of the Pay Equity Act.

A. Non-equity long-term cash rewards

To further describe various long-term cash-based reward circumstances, the following scenarios are provided, using the example of a non-equity long-term cash reward of 30% of an employees’ base pay.

Scenario 1: If the non-equity long-term cash reward is reset or offered every three years, then the target reward of 30% can be annualized for the purposes of pay equity.

Calculation: 30% ÷ 3 years = 10% of annual base pay

Conclusion: An additional 10% of the annual base pay of the employee should be included in the calculation of total compensation for the job class.

Scenario 2: If the non-equity long-term cash reward is annually recurring (for example, 30% of the base pay is to be paid at the end of the applicable three-year timeline), then the full reward value, or 30% of the base pay, can be used for the purposes of pay equity.

Calculation: 30% of annual base pay

Conclusion: An additional 30% of the annual base pay should be included in the calculation of total compensation for the job class.

Scenario 3: If the non-equity long-term cash reward is ad hoc or milestone-based and not part of a defined schedule, then the reward can be divided by a three-year time horizon for the purposes of pay equity.

Calculation: 30% ÷ 3 years = 10% of annual base pay

Conclusion: An additional 10% of the annual base pay should be included in the calculation of total compensation for the purposes of pay equity.

B. Equity-based long-term incentives (LTIs)

Stock options

Scenarios that offer approaches for calculating amounts to be used for pay equity purposes are provided below.

Scenario 1: Annual and recurring LTI stock option grant amounts are received based on defined stock option plan eligibility and related terms and conditions. This scenario also assumes eligible employees are meeting target performance expectations.

Calculation: Based on defined classification level or job-specific target grant practices, the full annual LTI grant value would be used. This in turn will need to have a formal valuation methodology (for example, Black-Scholes) applied to determine the estimated compensation value for pay equity calculation purposes.

Conclusion: For pay equity, the annual valuation amounts are to be included in the calculation of total compensation for the job class.

Scenario 2: A one-time or one-off milestone-based LTI stock option grant, where the milestone event could be the first day of employment, a financing development such as an initial public offering or a unique performance milestone at either the team or enterprise level.

Calculation: Based on defined classification level or job-specific target grant practices, the milestone-based LTI stock option grant value could be calculated by dividing the number of vesting years specified in the formal stock option plan to determine the annual specific grant value. This in turn will need to have a formal valuation methodology (for example, Black-Scholes) applied to determine the estimated compensation value for pay equity calculation purposes.

Conclusion: For pay equity, the annual valuation amounts are to be included in the calculation of total compensation for the job class.

Scenario 3: Any long-term incentive amounts received for above-target performance at the individual incumbent or job class level that do not meet the criteria for exclusion must be considered in the calculation of total compensation for each job class for which the value of work has been determined.

Calculation: Based on defined classification level or job-specific target grant practices, the full annual long-term incentive grant value would need to be calculated. This calculation should be based on a formal valuation methodology (for example, Black-Scholes) to determine the estimated compensation value for pay equity calculation purposes.

Conclusion: For pay equity, the annual valuation amounts are to be included in the calculation of total compensationxi for a job class if they do not meet the exclusion criteria.xii

Restricted stock or share units (RSUs)

For illustrative purposes, the following scenarios provide examples for how RSUs may be offered and used for calculating the total compensation of a job class for pay equity purposes.

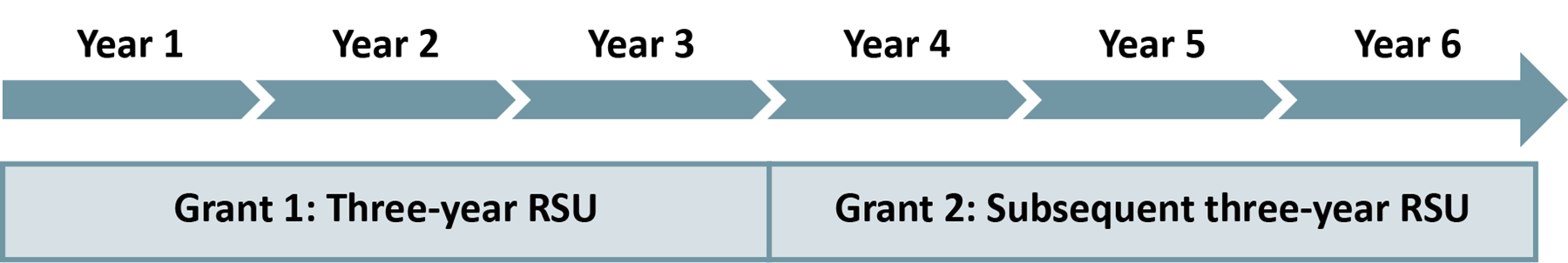

Scenario 1: An RSU grant for meeting defined longer-term retention milestones, with a subsequent RSU grant once the original RSU milestone has been met.

Description: The employee receives a three-year RSU grant payable once longer-term retention milestones are achieved, and a subsequent or reset RSU grant is provided for the following three-years. In this example, therefore, two RSU grants span an aggregate six-year time horizon.

Calculation: Based on classification level or job-specific RSU grant practices, calculate using an annualized valuation using the number of RSUs and a defined valuation methodology. For example, a three-year RSU grant of 900 RSUs, divided by the three years, yields 300 RSUs, multiplied by the share price at the time of the grant.

Conclusion: For pay equity, these amounts are to be included in the calculation of total compensation for the job class if they do not meet the section 46 exclusion criteria.

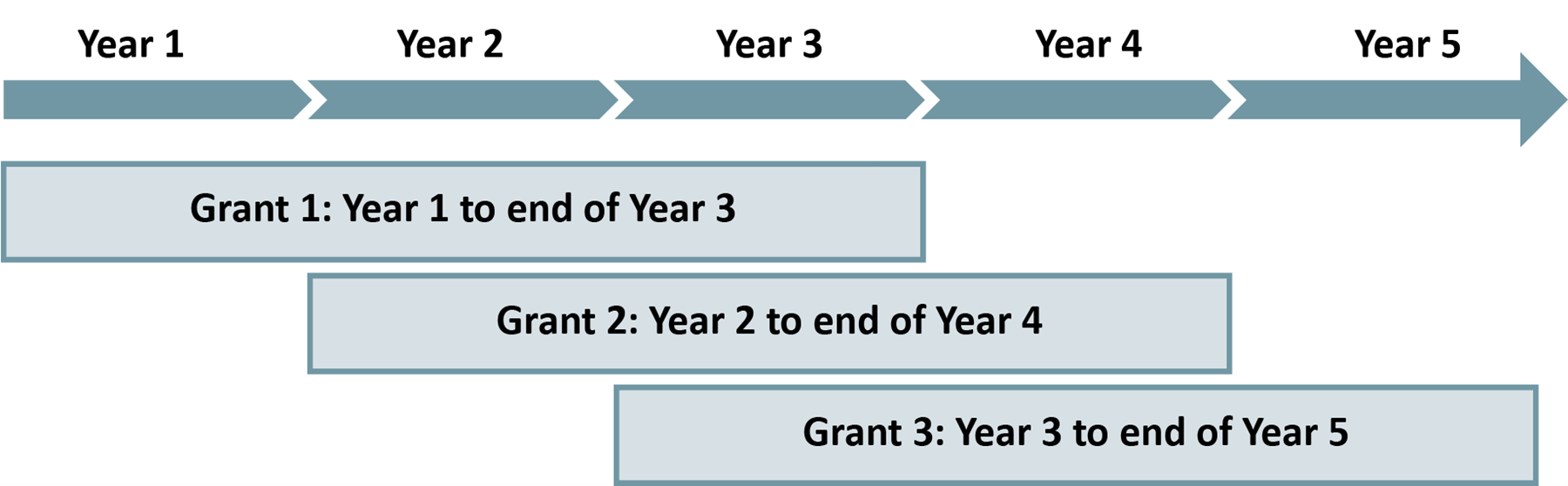

Scenario 2: Annual and recurring RSU grants for meeting defined longer-term retention milestones.

Description: The employee receives an annual RSU grant payable if the longer-term retention milestone is achieved—for example, in three years’ time. As illustrated, the annual RSU grants are offered on a recurring year-over-year annual basis:

Calculation: Based on classification level or job-specific RSU grant practices, calculate using an annualized valuation of the RSU grant(s) based on a defined valuation methodology.

Where there are recurring RSU grants, use the RSU grant value (based on a formal valuation methodology) for the compensation year in question. In situations where the amounts of the RSU grant varies, the employer or pay equity committee may use the average or median.

Conclusion: For pay equity, these amounts are to be included in the calculation of total compensation for the job class if they do not meet the section 46 exclusion criteria.

Performance share units (PSUs)

Scenarios that offer approaches for calculating amounts to be used for pay equity purposes are provided below.

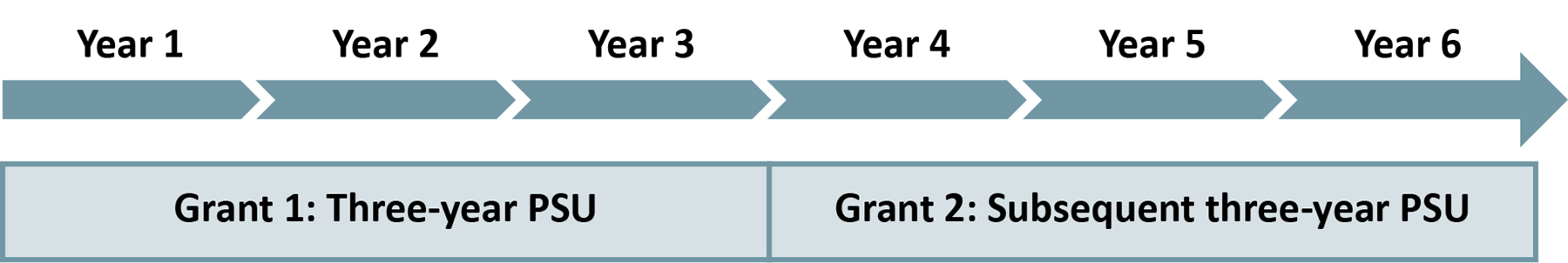

Scenario 1: A PSU grant for incenting and rewarding defined and measured longer-term enterprise-wide performance-based target or milestone results, with a subsequent PSU grant once the original PSU plan has expired.

Description: The employee receives a three-year PSU grant payable if longer-term enterprise-wide performance targets or milestones are achieved, and a subsequent or reset PSU grant is provided for a subsequent three-year enterprise-wide cycle. In this example, two PSU grants spanning an aggregate six-year time horizon are illustrated:

Calculation: Based on classification level or job-specific PSU grant practices, calculate using an annualized valuation using the number of PSUs and a defined valuation methodology.

Conclusion: For pay equity, these amounts are to be included in the calculation of total compensation for the job class if they do not meet the section 46 exclusion criteria.

Scenario 2: Annual and recurring PSU grants for incenting and rewarding defined and measured longer-term enterprise-wide performance-based target or milestone results.

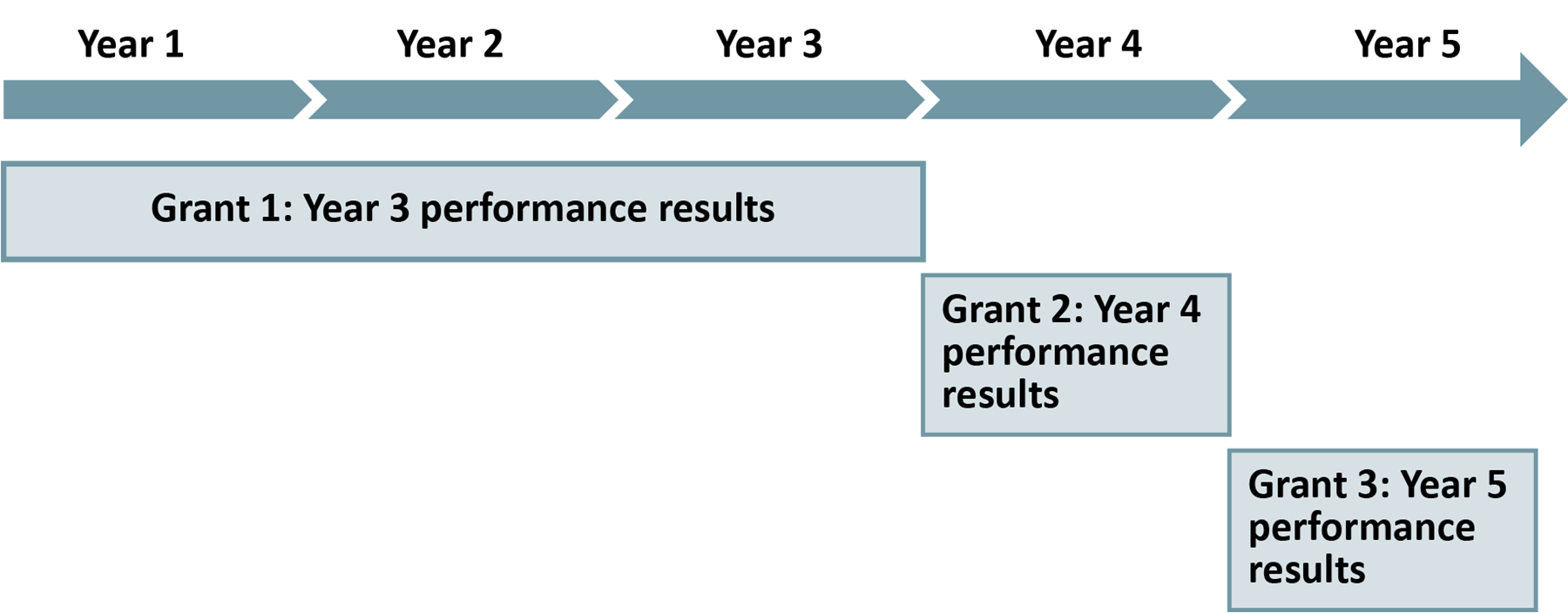

Description: The employee receives an annual PSU grant payable if the grant-specific longer-term enterprise-wide performance-based target or milestone results are achieved—for example, over a defined three-year time period. As illustrated, the annual PSU grants are offered on a recurring year-over-year annual basis:

Calculation: Based on classification level or job-specific PSU grant practices, calculate using an annualized valuation using the number of PSUs and a defined valuation methodology.

Where there are recurring PSU grants, use the PSU grant value (based on a formal valuation methodology) for the compensation year in question. In situations where the amounts of the PSU grant varies, the employer or pay equity committee may use the average or median.

Conclusion: For pay equity, these amounts are to be included in the calculation of total compensation for the job class if they do not meet the section 46 exclusion criteria.