Calculation of Compensation – No. 6 Guidance concerning the calculation of indirect compensation elements

1. Purpose

This Interpretation, Policy and Guideline (IPG) provides guidance on the following:

- The definition of compensation; and,

- The calculation of indirect compensation elements when determining the total compensation of a job class.

This IPG is the sixth in a series that addresses the calculation of compensation. The other IPGs in this series are:

- No. 1: Guidance Concerning the Definition of Compensation.

- No. 2: Exclusions.

- No. 3: An Interpretation of Salary and Determining the Highest Salary Rate.

- No. 4: Guidance Concerning the Calculation of Different Types of Variable Pay.

- No. 5: Guidance Concerning the Calculation of Different Types of Incentive Pay.

This document does not replace expert legal and/or compensation expertise and advice. This document is technical in nature and should not be used as a plain language resource. Plain language resources are available at https://www.payequitychrc.ca/en.

The term employer in this document can also refer to a group of employers that has been recognized by the Pay Equity Commissioner.i

2. Definition of compensation

Section 3(1) of the Pay Equity Act (the Act) defines compensation as any form of remuneration payable for work performed by an employee and includes:

- Salaries, commissions, vacation pay, severance pay and bonuses;

- Payments in kind;

- Employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and,

- Any other advantage received directly or indirectly from the employer.

For more information, see Calculation of Compensation – No. 1: Guidance Concerning the Definition of Compensation on the pay equity publications web page: https://www.payequitychrc.ca/en/publications.

2.1. Guidance on the interpretation of compensation

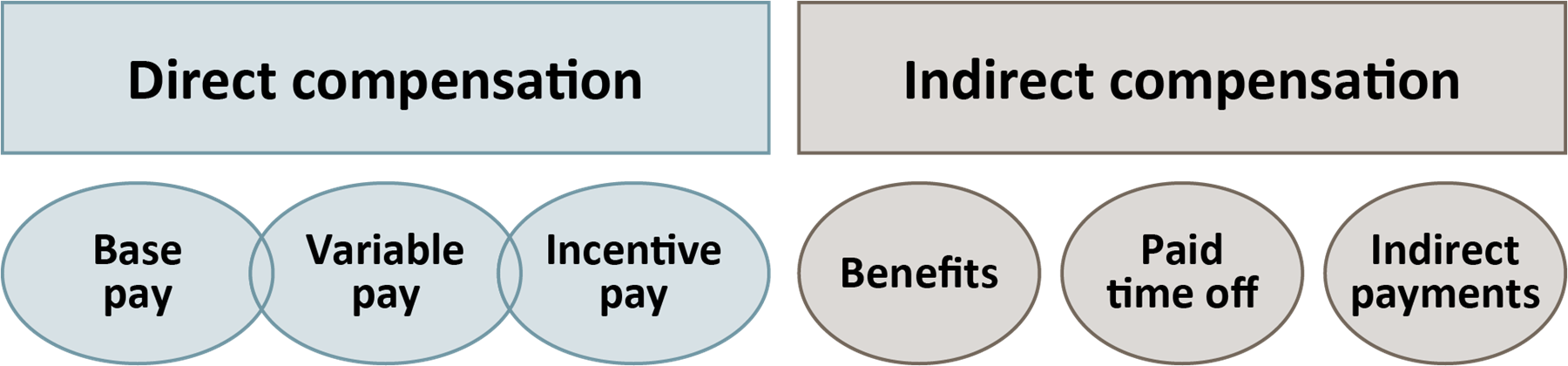

For the purposes of pay equity, the definition of compensation provided in the Act can be seen in the context of a total compensation model.

2.1.1. Total compensation model

Benefits, paid time off and indirect payments are indirect compensation elements of the total compensation model.

3. Guidance on identifying and calculating indirect compensation

Employers and pay equity committees must calculate the compensation of each job classii for which they have determined the value of work performed.iii

The calculation of total compensation for a job class must include indirect compensation elements, such as:

- Benefits, including pensions and retirement savings plans;

- Paid time off; and,

- Indirect payments.

The following sections provide guidance on how to calculate indirect compensation elements when determining the total compensation of a job class.

3.1. Identifying indirect payment elements

Indirect payment elements are forms of monetary and non-monetary amounts associated with paid employment.

Examples of indirect compensation elements are:

- Benefits received by employees, such as:

- Health and dental plans;

- Health spending accounts;

- Counselling services;

- Income protection, short-term disability, long-term disability and life insurance;

- Pension or RRSP plans; and,

- Severance entitlements.

- Paid time off, such as:

- Vacation;

- Paid sick leave;

- Bereavement or compassionate leave; and,

- Personal leave.

- Indirect payments, such as:

- Parking and car allowances, if not a business expense;

- Professional memberships, if not a condition of employment.

- Payments in kind; and,

- Interest-free loans.

- Any personal use indirect payments, such as:

- Personal cellular or computer allowances;

- Wellness and fitness benefits; and,

- Social or recreational memberships.

3.2. Calculating indirect compensation elements

Once an employer or pay equity committee has identified all of the indirect compensation elements that are provided to a job class, they may determine whether or not to include each element in the calculation of compensation.

Under section 45 of the Pay Equity Act, employers and pay equity committees may exclude an indirect compensation element if it is:

- Equally available to all job classes under the pay equity plan; and,

- Provided without discrimination on the basis of gender to all job classes under the pay equity plan.iv

If the benefit is equally available to all job classes in the pay equity plan and provided without discrimination on the basis of gender, it does not need to be included in the calculation of total compensation.

For more information on exclusions, see Calculation of Compensation – No. 2: Exclusions on the pay equity publications web page: https://www.payequitychrc.ca/en/publications.

Principles to consider when calculating indirect compensation elements include:

- Amounts must be included in the calculation of compensation should they not meet the section 45 exclusion criteria in the Pay Equity Act.

- As per section 46(f), the non-receipt of compensation in the form of benefits that have a monetary value or amounts of pay received in lieu of benefits must be included in the calculation of total compensation should they not meet the exclusion criteria.

- Should the employer or pay equity committee need to calculate amounts, they may choose to use the median or average amounts earned by all positions in the job class for the purpose of calculating total compensation.

- To assign a monetary value to compensation elements, the calculation should be based on employee eligibility and accessibility rather than employee usage.

- Compensation calculations must be expressed in dollars per hour.v

- Whichever approach is taken to calculate the amount of an element of indirect compensation, the same approach should be used across all of the job classes for which total compensation is being calculated.

- Where there is no prescribed methodology, such as those outlined by the Canada Revenue Agency, calculations should be based on the actual cost to the employer.

The Canada Revenue Agency has further descriptions and information concerning tax administration that may be helpful for calculations and pay equity purposes:

An overview of options for how to calculate indirect compensation elements for the purpose of pay equity comparisons is provided in the following sections. More detailed information is provided in the appendix.

3.2.1. Benefits

Generally, the cost of benefits should be based on employer contributions. For flexible plans, the calculation may be based on the total amount the employer allocates for each job class compared.

Health and dental benefits

To calculate the value of health and dental benefits for a job class, the employer or pay equity committee may consider using single coverage premium amounts. This can help negate any impacts that may disproportionately inflate pay equity calculations for predominantly female job classes.

Severance pay

Severance is money an employer pays an employee when they lose their job through no fault of their own.vi An employer may call it a severance package, a severance agreement, a retiring allowancevii or termination pay.viii It can be classified for tax purposes as employment income, a retiring allowance, non-taxable damages or a combination of all three.ix

Severance pay is regulated by employment law provincially, territorially and federally.x Severance may or may not be outlined in an employment contract.xi

There are three types of severance pay: common law severance, statutory severance and contractual severance.

Common law severance

Common law determinations of severance entitlements are generally used in those situations in which an employment contract does not stipulate or outline a valid severance provision.

Common law severance entitlements are generally higher than the minimum owed to employees under statutory severance provisions. Amounts are determined based on various factors, such as:

- The employee’s age at termination;

- The employee’s length of service;

- The employee’s salary;

- The employee’s character of employment; and,

- The availability of similar employment with regard to the employee’s experience, training and qualifications.xii

Statutory severance

Severance payments can be determined using statutory provisions, generally found in employment standardsxiii legislation for provincial, territorial and federal jurisdictions.

At the federal level, the current minimum rate that an employer who terminates the employment of an employee who has completed 12 consecutive months of continuous employment must provide is the greater of:xiv

- Two days’ wages at the employee’s regular rate for their regular hours of work in respect of each completed year of employment that is within the term of the employee’s continuous employment by the employer; and,

- Five days’ wages at the employee’s regular rate for their regular hours of work.

There are also increased severance amounts for group terminations under the Canada Labour Code.xv

This minimum rate for severance is not provided when an employee’s employment is terminated for just cause.xvi

Contractual severance

Severance payments can be determined using terms and provisions outlined in an employment contract.

Three scenarios are provided as guidance for employers and pay equity committees on how to calculate severance amounts for pay equity purposes.

Scenario 1: All the positions in a job class have employment contracts that stipulate or outline no severance provisions.

Description: May exist in organizations where informal employment contracts are in place. Typically employment contracts do not exist, or where they do, they do not include severance provisions.

Pay equity approach: There are two approaches that the employer or pay equity committee may consider for the purpose of determining pay equity severance amounts to be included in the calculation of total compensation:

- Approach 1: The median or average amounts awarded over a representative period of time that reflect similar past circumstances through common law notice may be used.

- Approach 2: Where previous common law notice amounts do not exist, the average or median of statutory or contractual amounts may be used.

It is important to note that, should a case be brought to court, common law notice amounts may not coincide with amounts used for the purposes of pay equity. Common law severance notice amounts vary significantly and are based on numerous factors.

Scenario 2: All the positions in a job class receive statutory severance.

Description: May exist when collective agreements or employment contracts state that only statutory employment standards provisions in the Canada Labour Code will apply.

Pay equity approach: In the circumstance in which all the positions in a job class receive the legislative minimum outlined in the Canada Labour Code, the employer or pay equity committee may calculate the severance entitlement amount for the year in which the pay equity plan is being established for each position and use the median or average of these amounts for the purpose of calculating total compensation.

In cases where all the job classes under the pay equity plan receive the legislative minimum outlined in the Canada Labour Code, the employer or pay equity committee may decide to exclude these amounts should they meet the exclusion criteria outlined in section 45 of the Pay Equity Act.

Scenario 3: Positions in a job class all have employment contracts that include a severance pay clause that exceeds statutory legal requirements in the Canada Labour Code.

Description: In the circumstance where the employee is provided a greater severance entitlement than the statutory minimum, the details of the entitlement are outlined in an employment contract or a compensation contract. The terms and provisions of these clauses cannot be less than the statutory severance requirements under the Canada Labour Code.

Pay equity approach: The employer or pay equity committee may calculate the severance entitlement amount for each position for the year in which the pay equity plan is being established and use the median or average of these amounts for the purpose of calculating total compensation.

Examples of other types of benefits and approaches for calculating their amounts for the purposes of pay equity can be found in the appendix.xvii

3.2.2. Paid time off

The value of paid time off is most often linked to the employee’s salary. For plans not linked to the employee’s salary, value is calculated based on employer contributions to the paid leave plans.

Examples of different types of paid time off and approaches for calculating their amounts for the purposes of pay equity can be found in the appendix.xviii

3.2.3. Indirect payments

A calculation of indirect pay elements should be based on cost to the employer. Elements required to be paid by legislation, such as occupational health and safety legislation, or elements recognized as a business expense do not need to be included in the calculation of total compensation.

Examples of different types of indirect pay and approaches for calculating their amounts for the purposes of pay equity can be found in the appendix.xix

4. Referenced Pay Equity Act provisions

3(1)

compensation means any form of remuneration payable for work performed by an employee and includes

- salaries, commissions, vacation pay, severance pay and bonuses;

- payments in kind;

- employer contributions to pension funds or plans, long-term disability plans and all forms of health insurance plans; and

- any other advantage received directly or indirectly from the employer. (rémunération)

Calculation

44 (1) An employer — or, if a pay equity committee has been established, that committee — must calculate the compensation, expressed in dollars per hour, associated with each job class for which it has determined, under section 41, the value of the work performed.

Group of job classes

(2) If an employer or pay equity committee, as the case may be, treats a group of job classes as a predominantly female job class in accordance with section 38, the compensation associated with that job class is considered to be the compensation associated with the individual predominantly female job class within the group that has the greatest number of employees.

Salary

(3) For the purpose of determining salary in the calculation of the compensation associated with a job class, the salary at the highest rate in the range of salary rates for positions in the job class is to be used.

Exclusions from compensation

45 An employer — or, if a pay equity committee has been established, that committee — may exclude from the calculation of compensation, with respect to each job class in respect of which compensation is required to be calculated, any form of compensation that is equally available, and provided without discrimination on the basis of gender, in respect of all of those job classes.

Contents of plan

51 A pay equity plan must

- indicate the number of pay equity plans required to be established in respect of the employer’s employees or, if the employer is in a group of employers, in respect of the employees of the employers in the group;

- indicate the number of employees that the employer — or, in the case of a group of employers, each employer in the group — was considered to have for the purpose of determining whether a pay equity committee was required to be established in respect of the pay equity plan;

- indicate whether a pay equity committee has been established and, if so, whether it meets the requirements set out in subsection 19(1) or, if not, whether the employer or group of employers, as the case may be, obtained the authorization of the Pay Equity Commissioner to establish a pay equity committee with different requirements;

- set out a list of the job classes that have been identified to be job classes of positions occupied or that may be occupied by employees to whom the pay equity plan relates;

- indicate whether any job classes referred to in paragraph (d) were determined to be predominantly female job classes and, if so, set out a list of those job classes;

- indicate whether any job classes referred to in paragraph (d) were determined to be predominantly male job classes and, if so, set out a list of those job classes;

- indicate whether a group of job classes has been treated as a single predominantly female job class and, if so, set out a list of the job classes referred to in paragraph (d) that are included in the group of job classes and identify the individual predominantly female job class within the group that was used for the purpose of subsections 41(3) and 44(2);

- if there was a determination of the value of work performed in certain job classes, then, for each of those job classes, describe the method of valuation that was used and set out the results of the valuation;

- indicate any job classes in which differences in compensation have been excluded from the calculation of compensation under section 46 and give the reasons why;

- if a comparison of compensation was made, indicate which of the methods referred to in subsection 48(1) was used to make the comparison — or, if neither was used, explain why not and describe the method that was used — and set out the results of the comparison;

- identify each predominantly female job class that requires an increase in compensation under this Act and describe how the employer — or, in the case of a group of employers, each employer in the group — will increase the compensation in that job class and the amount, in dollars per hour, of the increase;

- set out the date on which the increase in compensation, or the first increase, as the case may be, is payable under this Act; and

- provide information on the dispute resolution procedures that are available under Part 8 to employees to whom the pay equity plan relates, including any timelines.

Appendix

The information below is provided as examples and is not mandatory. It is up to the workplace parties to discuss together how they wish to operate and to adopt an approach that works for them while at the same time advancing the purposes of the Pay Equity Act.

Benefits

The information below is not exhaustive but may be used as a reference to calculate the various forms of benefits that may be present in a workplace.xx

Extended health care

| Type | Characteristics | How to calculate |

|---|---|---|

| Coverage for expenses not included in provincial heath care plans |

May include prescription drugs, semi-private or private hospital rooms, vision and hearing care, paramedical services and medical supplies. The employer may pay, or employee may purchase coverage as part of a flexible benefits package. |

Value direct employer cost if applicable. Use the same type of coverage for all. For example, if using single coverage premium amounts, use for all employees. If part of a flexible benefits package, use the amount allocated to the job class by the employer regardless of whether or how individual employees use the credits. |

| Dental coverage | Plan that covers some or all regular dental care, sometimes including orthodontic care for employees and family members. |

Value direct employer cost if applicable. Use the same type of coverage for all. For example, if using single coverage premium amounts, use for all employees. If part of a flexible benefits package, use the amount allocated to the job class by the employer regardless of whether or how individual employees use the credits. |

| Health care reimbursement account | The employer sets aside pre-tax dollars to reimburse employees for all or part of the cost of particular benefits, such as vision care, child care and integrative health care. |

Value direct employer cost if applicable. Use the same type of coverage for all. For example, if using single coverage premium amounts, use for all employees. If part of a flexible benefits package, use the amount allocated to the job class by the employer regardless of whether or how individual employees use the credits. |

Disability coverage

| Type | Characteristics | How to calculate |

|---|---|---|

| Short-term and long-term disability |

Covers a percentage of an employee’s salary if they are disabled and not able to work after a prescribed waiting period. Employee may purchase coverage as part of a flexible benefits package. |

Value employer cost of program for job class. |

Employee assistance and counselling

| Type | Characteristics | How to calculate |

|---|---|---|

| Access to counselling and advice services | Services may be provided by the employer, or the employer may reimburse a percentage of the cost paid by the employee. Examples include psychological counselling or testing, assistance for families adopting a child and stop-smoking programs. | Value employer cost of program for job class. |

Life insurance

| Type | Characteristics | How to calculate |

|---|---|---|

| Life insurance, accidental death and dismemberment and critical illness insurance |

Coverage provided by the employer, generally in relation to the employee’s salary. The employee may be given the option to purchase additional coverage at special rates as part of a flexible benefits package. |

Value direct employer contributions to the insurance plan and account for value of special rates available in a flexible benefits package. |

Retirement income arrangements

| Type | Characteristics | How to calculate |

|---|---|---|

| Defined benefit pension plan |

Pension guaranteed by the plan sponsor, generally in relation to earnings and years of service. The employee may or may not contribute. |

Employer contributions are determined by the present value of the annual contribution—the actuarially defined employer’s cost or the annual employer contribution rate. |

| Group RRSP |

The employer arranges group plan for employees, but does not necessarily contribute. No pension guaranteed, but employees may benefit from reduced fees and convenience of payroll deductions, etc. |

Employer contributions are determined by the present value of the annual contribution—the actuarially defined employer’s cost or the annual employer contribution rate. |

| Money purchase or defined contribution pension plan |

The employer contributes a percentage of salary to the fund, but no particular pension is guaranteed. Retirement income may vary according to investment returns and rates of interest prevailing when an employee retires. |

Include amounts contributed by the employer and/or the contribution rate. If the defined contribution plan is available to all job classes and the plan meets the criteria, amounts may be excluded under section 45 of the Pay Equity Act. |

Post-retirement benefits

| Type | Characteristics | How to calculate |

|---|---|---|

| Continuation of some benefits after employee retires or terminates employment | Group health and/or dental plans, life insurance, disability income and other benefits may continue after the employee retires, with the cost shared between the employer and the former employee. | Follow accounting rules requiring the employer to show the expense based on projected benefit obligations for active and retired employees. |

Flexible benefit credits

| Type | Characteristics | How to calculate |

|---|---|---|

| Credits toward the purchase of various types of benefits |

Employees are given a certain amount of flex credits that may be used to purchase varying amounts of coverage of benefit options. Sometimes unused credits may be deposited in the employee’s health reimbursement account. Employer contributions generally take the form of a flat dollar amount that may or may not be related to salary. |

Use the amount allocated to the job class by the employer regardless of whether or how individual employees use the credits. |

Other monetary benefits

| Type | Characteristics | How to calculate |

|---|---|---|

| Stock or share purchase plans | Employees are given the option of purchasing stock in the company at a discount. They may then be able to sell it at a profit. | The employer or pay equity committee may calculate amounts using the average or median employer contribution rate for each job class. |

| Income supplement programs over statutory minimums | Employees are provided supplementary payments by the employer while not at work. | Should amounts not qualify for section 45 exclusion under the Pay Equity Act, the employer or pay equity committee should include amounts over statutory minimums contributed by employer. |

Paid time off

The information below is not exhaustive but may be used as a reference to calculate the various forms of paid time off that may be present in a workplace.xxi

| Type | Characteristics | How to calculate |

|---|---|---|

| Annual vacation, paid holidays and floating days | For paid time off in excess of statutory requirements. | Value according to access to the benefit, not usage. |

| Supplementary vacation and special provisions | Employees may be entitled to additional vacation or days off after a certain age and/or number of years of service. | Value according to access to the benefit, not usage. |

| Personal leaves | Other types of leave with pay—for example, for personal reasons, religious holidays, divorce, political activity, medical appointments, educational leave and sabbaticals and paid sick leave other than statutory paid leaves. | Value according to access to the benefit, not usage. |

| Short-term and long-term family leave | Includes parental leave and leave for child care, eldercare and other family reasons. |

Include amounts contributed by the employer. Where there is access to employment insurance benefits, these do not have to be included, but the employer may top up leave and/or benefits. |

Indirect payments

The information below is not exhaustive but may be used as a reference to calculate the various forms of indirect pay that may be present in a workplace.xxii

| Type | Characteristics | How to calculate |

|---|---|---|

| Tools, uniforms, clothing allowances, parking privileges, supply of vehicles, etc. | May include the supply of tools, uniforms, vehicles, etc. | Include the cost to the employer of supplying the benefits to the job classes, except where required under occupational health and safety legislation or when not a business requirement or expense. |

| Meal allowances, subsidized cafeterias, executive dining rooms, etc. | Non-wage benefits provided to employees. | Include the cost to the employer of supplying the benefits to the relevant job classes when not a business requirement or expense. |